FMCG Sector

Date Published: May 11, 2023

Introduction on FMCG industry :

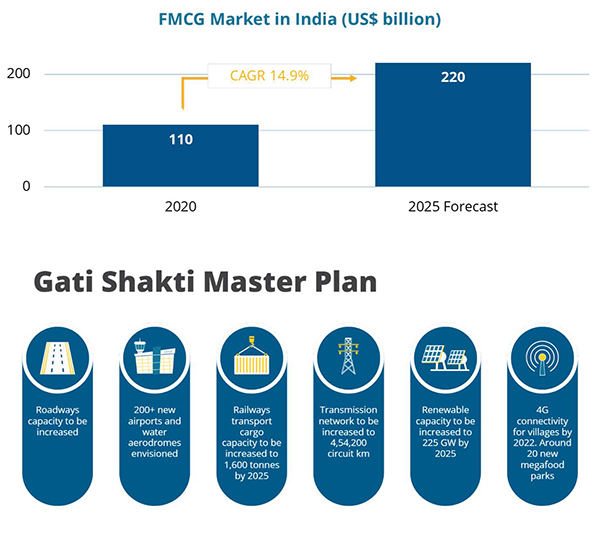

Fast-Moving Consumer Goods (FMCG) can be defined as packaged goods that are consumed or sold at regular and small intervals. Household and personal care products accounts for 50% of the sales in the FMCG industry, healthcare accounts for 31-32% and food and beverage accounts for the remaining 18-19%. Fast-moving consumer goods (FMCG) sector is India’s fourth-largest sector and has been expanding at a healthy rate over the years as a result of rising disposable income, a rising youth population, and rising brand awareness among consumers. With household and personal care accounting for 50% of FMCG sales in India, the industry is an important contributor to India’s GDP. It provides employment to around 3 million people accounting for approximately 5% of the total factory Employment in India. It is an important contributor to India’s GDP growth. Growth in the country’s FMCG sector is being fuelled by improving scenarios in both demand as well as supply side. India is a country that no FMCG player can afford to ignore due to its middle-class population which is larger than the total population of USA. The Indian FMCG market continues to rise as more people start to move up the economic ladder and the benefits of economic progress become accessible to the general public. More crucially, with a median age of just 27, India's population is becoming more consumerist due to rising ambitions. This has been further aided by government initiatives to increase financial inclusion and establish social safety nets. Growing awareness, easier access and changing lifestyles have been the key growth drivers for the sector. The urban segment (accounts for a revenue share of around 55%) is the largest contributor to the overall revenue generated by the FMCG sector in India. However, in the last few years, the FMCG market has grown at a faster pace in rural India compared to urban India. Semi-urban and rural segments are growing at a rapid pace and FMCG products account for 50% of the total rural spending. Fast-moving consumer goods include packaged food, toiletries, beverages, stationery, over-the-counter medicines, cleaning and laundry products, plastic goods, personal care products, as well as less expensive consumer electronics, such as mobile phones and headphones.

India’s Consumer Goods Market Drives Growth In the Post-COVID Era

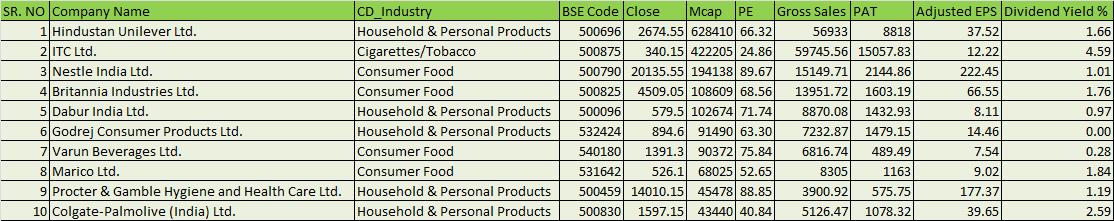

India’s consumer market, with its dramatic increase in demand, rapid economic growth and rising young technical labor force, makes it an increasingly interesting FDI destination. India’s economy is domestic consumption-driven by its population of 1.4 billion. It is the third largest economy in the world in terms of purchasing power parity, a fact that is increasingly impossible for multinational companies to ignore. The Indian economy has recovered to pre-pandemic levels, with real GDP growth in FY 2021-22 at 8.2%, 1% higher than in FY 2019-20. Fast-moving consumer goods (FMCG) sales are fueling economic expansion, as they increased by 16% in 2021, driving a nine-year high in consumption-led growth. FMCG is the fourth-largest sector in the Indian economy, with a market size of US$110 billion in 2020. It is expected to double by 2025. More than half of the overall revenue in FMCG comes from the urban segment, but rural markets show the fastest year-over-year growth. Market share is 50% for Household and Personal Care, followed by Healthcare (31%) and Food and Beverages (19%). The shift to an organized market, increasing rural consumption and e-commerce are the key drivers of FMCG growth in India.

Government Support to Boost Domestic Manufacturing

India’s government recognizes that now is the time to promote manufacturing FDI. To lure foreign companies to invest in India, the government in October 2021 launched a new scheme called “Gati Shakti” or “Strength and Speed” to streamline the notoriously bureaucratic and cumbersome processes of establishing an entity and obtaining the numerous approvals and operating licenses to do business. Under this program, 16 ministries will be connected through a single digital platform, providing investors a one-stop solution for approvals. In October, Prime Minister Narendra Modi approved $1.2 trillion to boost the program and help speed up infrastructure projects, especially roads, railway networks, ports and airports.

To encourage domestic and foreign companies to manufacture in India, the government introduced a series of Production Linked Incentive (PLI) schemes across 14 key sectors. The schemes provide companies with incentives based on sales of domestically manufactured products. The program also aims to create jobs and reduce the country’s reliance on imports from other countries. The program has been welcomed by MNCs across the country, particularly in the FMCG sector.

With the growth of FMCG, multinationals such as Hindustan Unilever, Nestlé and PepsiCo have expanded their manufacturing for domestic consumption as well as for exports to Canada, the U.K., Singapore and Africa. To promote investment into FMCG, the government has relaxed license rules in food and agrifood processing, allowing 100% FDI into single-brand retail and the cash-and-carry market, as well as 51% foreign ownership in multi-brand retail.

INVESTMENTS

- The Government has allowed 100% Foreign Direct Investment (FDI) in food processing and single-brand retail and 51% in multi-brand retail.

- This would bolster employment, supply chain and high visibility for FMCG brands across organised retail markets thereby bolstering consumer spending and encouraging more product launches.

- The sector recorded an FDI of US$ 20.84 billion between April 2000-June 2022.

Some of the recent developments in the FMCG sector are as follows:

- According to a joint report released by industry body FICCI and property consultancy firm Anarock, Indian e-commerce market is expected to reach US$ 120 billion by 2026 from US$ 38 billion in 2021

- In October 2022, Dabur acquired 51% stake in Badshah Masala Private Limited for Rs. 587.52 crore, (US$ 71.81 million) less proportionate debt as on the closing date, with the Badshah enterprise being valued at Rs 1,152 crore (US$ 140.81 million).

- In July 2022, Chief Minister of Uttar Pradesh Mr. Yogi Adityanath, inaugurated HUL’s ultra-modern factory in Sumerpur with a total investment of Rs. 700 crore (US$ 88.07 million) planned by 2025.

- In July 2022, Emami acquired 30% stake in Cannis Lupus to enter into the petcare segment in India.

- In July 2022, Godrej Consumer Products Limited (GCPL), unveiled Godrej Magic Bodywash, India‟s first ready-to mix bodywash at just Rs. 45 (US$ 0.57).

- In June 2022, PepsiCo India announced its expansion plans for its largest greenfield foods manufacturing plant that produces the popular Lay’s potato chips in Kosi Kalan, Mathura in Uttar Pradesh with an investment of Rs. 186 crore (US$ 23.84 million).

- In April 2022, Dabur India announced plans to induct a fleet of 100 Electric Vehicles in its supply chain for last-mile product distribution.

- In March 2022, Emami acquired Dermicool from Reckitt for Rs. 432 crore (US$ 55.37 million)

- In February 2022, Dabur India, formed an exclusive partnership with energy provider Indian Oil, which will give Dabur's products direct access to around 140 million Indane LPG consumer households across India.

- In February 2022, Dabur India achieved its goal to collect, process, and recycle approximately 22,000MT of post-consumer plastic three months early.

- In February 2022, Marico Ltd has announced aims to achieve net-zero emissions by 2040 in its global operations.

- In November 2021, Tata Consumer Products (TCPL) signed definitive agreements to acquire 100% equity shares of Tata Smart Foodz Limited (TSFL) from Tata Industries Limited for a cash consideration of Rs. 395 crore (US$ 53.13 million). This move was in line with TCPL’s strategic intent to expand into the value-added categories.

- In November 2021, Unilever Plc agreed to sell its global tea business to CVC Capital Partners for EUR 4.5 billion (US$ 5.1 billion. The business being sold—Ekaterra—hosts a portfolio of 34 tea brands including Lipton, PG Tips, Pukka Herbs and TAZO.

- In November 2021, McDonald’s India partnered with an FMCG company ITC to add a differentiated fruit beverage, B Natural, to its Happy Meal, which will be available across all McDonald’s restaurants in South and West India, primarily catering to children aged 3–12 years.

- In October 2021, Procter & Gamble announced an investment of Rs. 500 crore (US$ 66.8 million) in rural India.

- In September 2021, Vahdam India, an Indian tea brand, raised Rs. 174 crore (US$ 24 million) as part of its Series D round led by IIFL AMC’s Private Equity Fund.

- In September 2021, RP-Sanjiv Goenka Group entered the personal-care segment by launching skin and haircare products, aiming at a revenue of Rs. 400-500 crore (US$ 53.84-67.30 million) in the next 4-5 years.

- In September 2021, Adani Wilmar announced the opening of physical stores under the name ‘Fortune Mart’ that will exclusively sell Fortune and other Adani Wilmar brand products.

- The rural market registered an increase of 14.6% in the same quarter and metro markets recorded positive growth after two quarters. Final consumption expenditure increased at a CAGR of 5.2% during 2015-20.

- According to Fitch Solutions, real household spending is projected to increase 9.1% YoY in 2021, after contracting >9.3% in 2020 due to economic impact of the pandemic.

- The FMCG sector's revenue growth will double from 5-6% in FY21 to 10-12% in FY22, according to CRISIL Ratings.

GOVERNMENT INITIATIVES

Some of the major initiatives taken by the Government to promote the FMCG sector in India are as follows:

- As per the Union Budget 2022-23:

- Rs. 1,725 crore (US$ 222.19 million) has been allocated to the Department of Consumer Affairs

- Rs. 215,960 crore (US$ 27.82 billion) has been allocated to the Department of Food and Public Distribution.

- In FY 2021-22, the government approved Production Linked Incentive Scheme for Food Processing Industry (PLISFPI) with an outlay of Rs. 10,900 crore (US$ 1.4 billion) to help Indian brands of food products in the international markets.

- The government’s production-linked incentive (PLI) scheme gives companies a major opportunity to boost exports with an outlay of US$ 1.42 billion.

- In November 2021, Flipkart signed an MoU with the Ministry of Rural Development of the Government of India (MoRD) for their ambitious Deendayal Antyodaya Yojana – National Rural Livelihood Mission (DAY-NRLM) programme to empower local businesses and self-help groups (SHGs) by bringing them into the e-commerce fold.

- Companies are counting on recent budget announcements like direct transfer of 2.37 lakh crore (US$ 30.93 billion) in minimum support payment (MSP) to wheat and paddy farmers and the integration of 150,000 post offices into the core banking system to expand their reach in rural India.

- The Government of India has approved 100% FDI in the cash and carry segment and in single-brand retail along with 51% FDI in multi-brand retail.

- The Government has drafted a new Consumer Protection Bill with special emphasis on setting up an extensive mechanism to ensure simple, speedy, accessible, affordable and timely delivery of justice to consumers.

- The Goods and Services Tax (GST) is beneficial for the FMCG industry as many of the FMCG products such as soap, toothpaste and hair oil now come under the 18% tax bracket against the previous rate of 23-24%. Also, GST on food products and hygiene products has been reduced to 0-5% and 12-18% respectively.

- GST is expected to transform logistics in the FMCG sector into a modern and efficient model as all major corporations are remodelling their operations into larger logistics and warehousing.

Driving Factors Responsible for the Growth of the FMCG Sector.

Digitisation:

- In a country where 80% of sales still occur from local Kirana stores, it becomes critical to make sure that orders from such channels remain steady. That’s what digitisation has ensured over the past couple of years during multiple waves of the coronavirus pandemic.

- E-commerce share of total FMCG sales is expected to increase 11% by 2030.

- FMCG companies are bringing together suppliers, inventory management, and distributor management within one ecosystem with the help of digital capabilities.

- Technologies like Artificial intelligence, Big Data and Predictive Analysis are being increasingly used by FMCG companies to predict customer behaviour accurately, helping them to understand what actually interests their customers.

- Online grocery stores and online retail stores like Grofers, Flipkart, and Amazon are making FMCG products more readily available.

- Digital payments like E-wallet and UPI are making the transactions smoother and more convenient.

- The number of online users in India is expected to cross 850 million by 2025.

Increased Initiatives and Investments by the Government:

- The FMCG sector in India witnessed a robust Foreign Direct investment (FDI) inflow of 18.19 billion dollars in 2020.

- Goods and Service Tax (GST): GST has been quite favourable for FMCG companies. It brought the Indian Market under the same umbrella.

- With the implementation of Goods and Services Tax, the GST council has reduced the tax rates down to 5% on most of the processed food items, increasing the consumption of food products.

- Along with that, the Production Linked Incentive (PLI) scheme proposed in November 2020 turned out to be extremely beneficial for the sector to boost manufacturing capacity and exports.

- The FMCG sector will also gain support from growth from the Inland Waterways Authority of India.

Growing Rural Market:

- The Retail market in rural India and rise in rural consumption is also responsible for driving the FMCG market.

- The contribution of the Retail market in rural India is 36% in the overall FMCG spending.

Growing Youth Population:

- Drift in the youth population in India is changing consumption trends, inclining more towards ready-to-eat food culture.

- India has more than 50% of its population below the age of 25 and more than 65% below the age of 35.

- The Processed Food Market of India is projected to reach 470 billion USD by the year 2025, from the 263 billion USD in 2020-21.

New Product in the Market:

- The FMCG sector raises product-launch capacity of different industries.

- In November 2021, Tru Nativ, a smart nutrition FMCG company, launched India's first family friend natural protein- 'Everyday Protein’ to defeat India's macronutrient deficiencies by providing natural food fortification solutions to customers.

- Beco,a startup in India,is revolutionising the FMCG market with low-cost, environmentally friendly consumer goods.

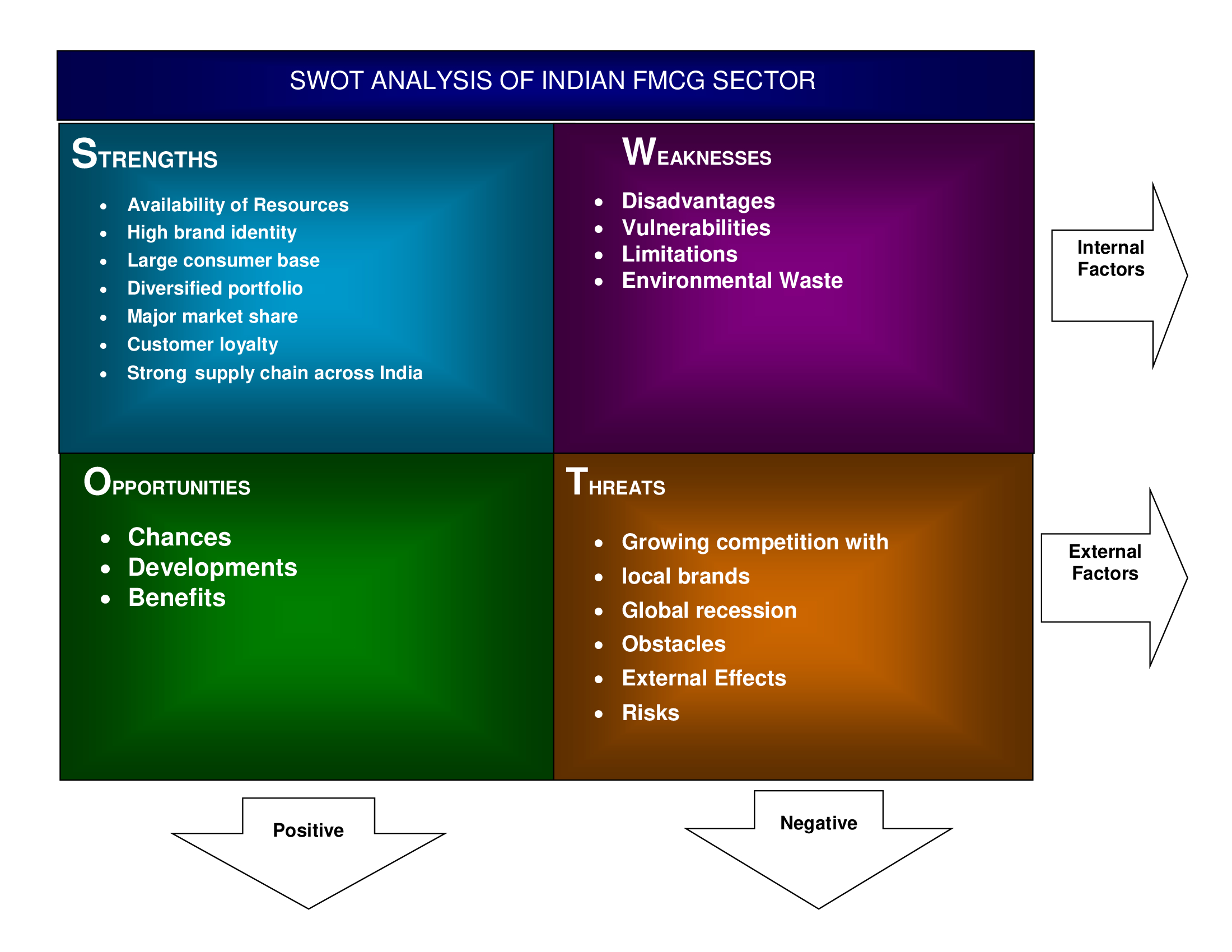

Challenges Associated with the FMCG Sector

High Inflation:

- The domestic FMCG industry is hit hard by inflation levels leading to successive price hikes as well as impacting volumes.

- The rural markets continued to witness a slower growth compared to the urban markets during the April-June, 2022.

- Increase in crude oil price means that crude oil-linked intermediates are likely to be expensive, affecting input costs for fabric and personal care products.

- Higher fuel prices will add to freight costs. Packaging costs will also go up.

Counterfeiting:

- Distribution centres, retail outlets, and third party logistics providers are the most vulnerable to infiltration of counterfeit products.

- Counterfeit products are fakes or unauthorised replicas of the real product.

Poor Supply Chain Infrastructure:

- Lack of storage and transport facilities coupled with rising costs of raw materials and energy has been a major challenge for the Indian FMCG market.

- Growth of many categories of FMCG have been severely constrained by the lack of cold chain infrastructure in the Indian market landscape.

- A Cold Chain Infrastructure includes temperature-controlled storage space, and transportation, trained operational, and servicing personnel with efficient management procedures.

Large Geographical Expanse:

- Large states in India such as Madhya Pradesh present a problem of large distances between two adjacent markets.

- This has a crippling effect on the viability of channel partners, which are serving the isolated markets.

Our Approach for FMCG Sector for smooth functioning.

Efficient Supply Chain Management:

- To prevent losses from the mismanagement of supply chain, FMCG companies in India have to ensure that they exercise greater control over their distribution channel and not just leave it to the market forces.

Prevention of Counterfeiting:

- Indian FMCG companies can collaborate with the retail industry to offer greater visibility and traceability.

- Measures such as regular spot checks, proper monitoring system, collaboration with local and national law enforcement agencies can be taken to curb counterfeiting.

Cyber-Security:

- Digitalisation in the consumer market is becoming a threat to privacy. The FMCG sector should adopt Cybersecurity measures to secure data and ensure consumer safety with a healthy National CyberSpace.

Reducing Transportation Costs:

- Manufacturing Industries collaborating with the third-party logistics partner can help in reducing the excess shipping cost.

Increasing Production Capacity:

- Specialisation of labour and more integrated technology boost production volumes.

- Emphasis should be given on skill development to produce a skilled efficient labour workforce.

- In November 2021, Flipkart signed an MoU with the Ministry of Rural Development of the Government of India (MoRD) for their ambitious Deendayal Antyodaya Yojana - National Rural Livelihood Mission (DAY-NRLM) programme to empower local businesses and Self-Help Groups (SHGs) by bringing them into the e-commerce fold.

- With proper utilisation of machinery, production cost per unit can be reduced that will in result boost the purchasing power of consumers.

Industry Contacts

Indian Dairy Association: Established in 1948, Indian Dairy Association (IDA) is the apex body of the dairy industry in India. The members are from the cooperatives, MNCs, corporate bodies, private institutions, educational institutions, government and public sector units. IDA functions very closely with the dairy producers, professionals & planners, scientists & educationists, institutions and organisations associated with the development of dairying in India. The IDA organises seminars, symposia and exhibitions on a wide range of topics catering to various segments of professionals, scientists, institutions and organisations associated with the development of dairying in India. The IDA's Head Quarter is in Delhi and the zonal branches are in Bangalore, Kolkata, Mumbai and Delhi. It has State Chapters at Anand (Gujarat), Thrissur (Kerala), Jaipur (Rajasthan), Chandigarh (Punjab), Patna (Bihar), Karnal (Haryana), Chennai (Tamil Nadu), Hyderabad (Andhra Pradesh) and Eastern UP Local Chapter.

All India Bread Manufacturers’ Association:

The All India Bread Manufacturer's Association has been serving the bread industry in the country for last 30 years, since its inception. AIBMA was registered under the Societies Registration Act, XXI of 1860 on 7th December 1978. The membership comprises of bread manufacturing units from large and small scale sectors all over India. Registration Act, XXI of 1860 on 7th December 1978.

Objective of the Association: The All India Bread Manufacturer's Association has been serving the bread industry in the country for last 30 years, since its inception in 1978. The membership comprises of bread manufacturing units from large and small scale sectors all over India. As a spokesman of the bread industry, the AIBMA maintains interaction with the government for promoting the bread industry in the country. Besides, the association effectively follows up the issues of concern to the bread industry pertaining to raw materials, quality aspects and promoting popularity of bread as nutritious wheat based food.

All India Food Processors’ Association:

All India Food Processors’ Association (AIFPA) was established in the year 1943 by visionaries who pioneered the Food Processing Industry in India that too in the most turbulent period of World War-II and the Indian Freedom Struggle. They perceived the need for scientific management of the vast panorama of Agro-Food Sector, with an emphatic focus on the development, promotion and establishment of Food Processing Industries in the country. The objective was to prevent the wastage of fresh farm produce through its preservation and value addition, so as to make it available round the year at affordable prices to the common consumer. Make your dreams come true with. At the same time, it was the only way to save the poor farmer from perennial economic losses caused by distress sale of his perishable farm produce.

Role of AIFPA

Ever since its inception, AIFPA has been discharging its role as a pathfinder for the Indian Food Processing Industry to provide access to newer technologies, critical process plant & machinery, modern packaging machines, efficient logistics and enabling marketing infrastructure etc. As the exclusive representative of Food Processing Industry in the country, AIFPA has always undertaken the responsibility of policy interventions with the concerned Government Agencies, to bring about necessary changes as and when required, in order to mitigate the bottlenecks which hinder the growth of Food Processing Sector in the country. Alleviating the problems of the MSME sector which produces over 85% of the food has for ever been the endeavour of AIFPA.

Indian soap and toiletries manufacturers’ association:

IBHA is a non-profit organisation registered under Section 8 of Companies Act 2013, with big, medium and small-scale companies as its members. IBHA (formerly known as ISTMA – Indian Soaps and Toiletries Makers’ Association) was established in Kolkata in 1937. In 1973, the Association shifted its operations to Mumbai. ISTMA was rechristened as IBHA in October 2012. Since then IBHA has had a fairly rich experience. It has brought into focus several issues of critical importance to the industry as a whole starting with the government, during the pre-liberalization era and has kept the momentum going ever since. As an apex trade body, we represent the industry in a number of policy issues with major statutory authorities.

The Association has well defined objectives in place such as:

- Representing the industry in providing technical perspectives on new regulations to the Government, be it amendments to regulations or other technical issues related to cosmetics.

- Proposing and leading reforms in cosmetic regulations that will create space for the industry to deliver innovative products to consumers on a regular basis.

- Regulating public policy through regular government interface, thereby protecting the industry’s interests. Going forward, IBHA hopes to become the leading and most trusted Indian Cosmetic Industry Association in providing consumer protection and enhancing industry competitiveness. It is our endeavour to build IBHA to be on par with International Cosmetic Industry Associations and be recognised on a global footing.

INDIA'S FOOD PROCESSING INDUSTRY:

The Indian food processing industry is among the largest in the nation in terms of growth, production, consumption and exports. The industry produces several food products such as meat, poultry, fisheries, fruits, vegetables, spices, milk and milk products, alcoholic beverages, plantations and grains. It also manufactures cocoa products and chocolates, confectionery, mineral water, soya-based items and high-protein foods. Since the liberalization in August 1991, the government proposed and accepted multiple projects, for instance, creating foreign collaborations, joint ventures, 100% export-oriented units and industrial licenses to encourage growth and investment in the food processing industry. Foreign direct investment (FDI) in India was estimated at Rs. 2,934.1 crore (US$ 368.8 million) in FY21. India is a major producer of food in the world, with a large and growing market. The food and grocery retail market, valued at US$ 11.3 trillion in 2021, is also among the largest in the global economy.

India's food processing sector is a sunrise sector that has gained prominence in recent years. Major processed food products exported from India include processed fruits and juices, pulses, guar gum, groundnuts, milled products, cereals preparations, oil meals and alcoholic beverages. India created history in agriculture and processed food exports by exporting products worth US$ 25.6 billion in FY22. Export of APEDA products stood at US$ 7.4 billion as of April-June 2022, up 31% compared with US$ 5.7 billion over the same period last fiscal, according to the Directorate General of Commercial Intelligence and Statistics. Furthermore, exports of processed fruits and vegetables grew by 59.1%; cereals and miscellaneous processed items grew by 37.66%; meat, dairy and poultry products grew by 9.5%; basmati rice grew by 25.5%; non-basmati rice grew by 5%; and miscellaneous products grew by 50%. The food sector is currently undergoing a transition in India. The Agricultural and Processed Food Products Export Development Authority (APEDA) forecasts that the sector will grow at a compounded annual growth rate (CAGR) of 3% between 2022 and 2030.

Non-alcoholic Beverages Market in India:

- The non-alcoholic beverages market in India was valued at INR 363.76 Bn in FY 2021 and is expected to reach INR 601.80 Bn by FY 2027, expanding at a CAGR of ~8.85% during the forecast period.

- Demand for the nation’s overall food and non-alcoholic beverage industry increased by 7.56% in August 2022 compared to the same month last year due to rising GDP, rising per capita income, and increasing e-commerce sales.

- Based on product type, the non-alcoholic beverage market in India can be segmented into carbonated and non-carbonated beverages.

- The market share of the carbonated beverages segment is anticipated to drop during the forecast period (FY 2022- FY 2027) due to consumers switching from sugar-loaded carbonated drinks to healthier non-carbonated substitutes such as fruit drinks and juices.

ROAD AHEAD for FMCG Sector:

Rural consumption has increased, led by a combination of increasing income and higher aspiration levels. There is an increased demand for branded products in rural India. On the other hand, with the share of unorganized market in the FMCG sector falling, the organized sector growth is expected to rise with increased level of brand consciousness, augmented by the growth in modern retail. Another major factor propelling the demand for food services in India is the growing youth population, primarily in urban regions. India has a large base of young consumers who form majority of the workforce, and due to time constraints, barely get time for cooking. Online portals are expected to play a key role for companies trying to enter the hinterlands. Internet has contributed in a big way, facilitating a cheaper and more convenient mode to increase a company’s reach. The number of internet users in India is likely to reach 1 billion by 2025. It is estimated that 40% of all FMCG consumption in India will be made online by 2020. E-commerce share of total FMCG sales is expected to increase by 11% by 2030. It is estimated that India will gain US$ 15 billion a year by implementing GST. GST and demonetization are expected to drive demand, both in the rural and urban areas, and economic growth in a structured manner in the long term and improved performance of companies within the sector.