Canara Robeco Small Cap Fund

Date Published: November 3, 2022

FUND FACTS

|

Nature |

Open ended |

Fund Manager |

Ajay Khandelwal, Shridatta Bhandwaldar |

|

Launch Date |

15-Feb-2019 |

Benchmark Index |

Nifty Smallcap 250 TRI |

|

NAV (Rs.) |

24.39 ( 13-Oct-2022 ) |

Corpus (Rs.in Crs.) |

3455.06 ( Aug-2022 ) |

|

Investment Objective |

Is to generate capital appreciation by investing perdominantly in Small Cap stocks. However, there can be no assurance that the investement objective of the scheme will be realized. |

||

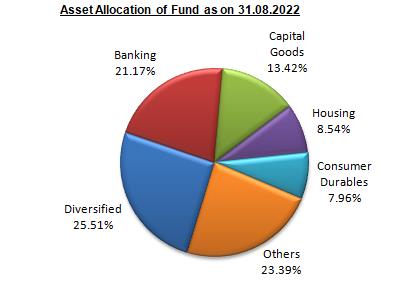

PORTFOLIO COMPOSITION

The fund has 93.75% of its net assets invested into equity & equity related instruments and balance 6.25% in cash and others. The large cap holdings constitute of 6.49% (market cap > Rs.47,228 crs), 19.42% in midcap (market cap > Rs.16,367 and Rs.16,367 crs), and balance 7.48 % in debt and cash component. The top 10 holdings of the scheme constitute 22.89% of its net assets. It may be observed that the Quarterly Average AUM of the fund for the end of June 2022 is Rs. 2010.49 crs.

| Sectoral Allocation (in %) as on 31.08.2022 | ||

| Top 10 Holdings of Fund | Fund Allocation | |

| Diversified | 25.51 | |

| Banking | 21.17 | |

| Capital Goods | 13.42 | |

| Housing | 8.54 | |

| Consumer Durables | 7.96 | |

| Chemicals | 6.73 | |

| Auto | 6.58 | |

| IT | 3.47 | |

| FMCG | 2.67 | |

| Textiles | 1.84 | |

| Month | Equity % | Cash % | Scheme % Monthly Returns(Month end) | Index % Monthly Returns(Month end) |

| Aug-22 | 93.75 | 6.25 | 3.87 | 5.64 |

| Jul-22 | 93.02 | 6.98 | 9.58 | 8.57 |

| Jun-22 | 91.02 | 8.98 | -4.07 | -5.67 |

| May-22 | 92.76 | 7.24 | -5.60 | -8.34 |

| Apr-22 | 92.44 | 7.57 | 1.25 | 1.97 |

| Mar-22 | 94.51 | 5.49 | 8.23 | 6.28 |

| Feb-22 | 93.85 | 6.15 | -3.60 | -8.44 |

| Jan-22 | 93.90 | 6.10 | 1.90 | -0.21 |

| Dec-21 | 92.30 | 7.70 | 4.85 | 5.40 |

| Nov-21 | 95.39 | 4.61 | -0.35 | -0.33 |

| Oct-21 | 96.07 | 3.93 | 1.70 | 0.84 |

| Sep-21 | 97.24 | 2.76 | 7.24 | 6.65 |

| Table: 3 | |||

| Top 10 Holdings (% in N.A) | Aug-22 | Feb-22 | Sept-21 |

| City Union Bank Ltd. | 2.99 | 1.81 | – |

| Schaeffler India Ltd. | 2.97 | 3.04 | 3.15 |

| Canfin Homes Ltd. | 2.64 | 2.63 | 2.65 |

| Grindwell Norton Ltd. | 2.25 | 2.56 | 2.73 |

| Cera Sanitaryware Ltd. | 2.24 | 2.59 | 2.99 |

| Century Textiles & Industries Ltd. | 2.07 | 1.34 | 2.05 |

| CreditAccess Grameen Ltd. | 1.95 | 1.89 | 1.42 |

| Mahindra Lifespace Developers Ltd. | 1.93 | 1.88 | 1.68 |

| The Great Eastern Shipping Company Ltd. | 1.93 | 1.73 | 2.44 |

| Timken India Ltd. | 1.92 | 1.41 | 1.47 |

PORTFOLIO ANALYSIS

In the latest portfolio, the fund held 71 scrips, out of which 52 scrips were held since one-year period (Aug-2022 to Sept-2021). Churning of the portfolio was observed much in this portfolio during the last one year. Canara Robeco Small Cap Fund scheme’s ability to deliver returns consistently is higher than most funds of its category. Its ability to control losses in a falling market is high. The fund has the majority of its money invested in Diversified, Financial, Capital Goods, Housing, Consumer Durables sectors. It has taken less exposure in Textiles, FMCG compared to other funds in the category. The fund’s top 5 holdings are in City Union Bank Ltd., Schaeffler India Ltd., Can Fin Homes Ltd., Grindwell Norton Ltd., Cera Sanitaryware Ltd.

Table 1 above tabulates the allocation of top 10 sectors by the fund. The fund has an allocation to 13 sectors, wherein the top 5 sectors constitutes to 76.61%. The fund could outperform its benchmark index in 08 out of 12 months during the last one year period, maintaining an average equity exposure of 93.85%.

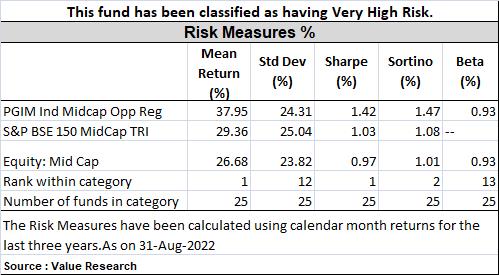

The risk parameter graph measures standard deviation (S.D.) across all the Small cap schemes. The S.D. of the scheme is 25.23%, which is lower than the industry average of the Small cap schemes of 26.39%. The Sharpe ratio of the scheme is 1.38%, which is higher than the industry average of 1.09%.

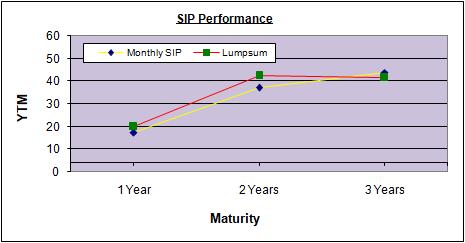

Monthly SIP and Lumpsum vis-à-vis Benchmark:

Exhibit 2

| Monthly SIPs Min (Rs.1000 p.m.) | |||||

| SIP Period | Amt Invst. (Rs.) | Canara Robeco Small Cap Reg (Rs.) | Nifty Smallcap 250 TRI (Rs.) | ||

| Market Value | Rets (%) | Market Value | Rets (%) | ||

| 1-Year | 12,000 | 13,100 | 17.37% | 12,278 | 4.31% |

| 2-years | 36,000 | 33,892 | 37.09% | 30,141 | 23.56% |

| 3-years | 60,000 | 66,303 | 43.92% | 56,862 | 32.02% |

| 5 years | – | – | – | – | – |

| 7 years | – | – | – | – | – |

| Monthly SIPs Min (Rs.1000 p.m.) | |||||

| SIP Period | Amt Invst. (Rs.) | PGIM Ind Midcap Opp Reg (Rs.) | Nifty Smallcap 250 TRI (Rs.) | ||

| Market Value | Rets (%) | Market Value | Rets (%) | ||

| 1-Year | 12,000 | 14,403 | 20.09% | 12,721 | 6.03% |

| 2-Years | 36,000 | 41,354 | 42.34% | 36,220 | 30.85% |

| 3-Years | 60,000 | 75,143 | 41.62% | 61,872 | 29.65% |

| 5 years | – | – | – | – | – |

| 7 years | – | – | – | – | – |

Note: (1) Performance is on August 31, 2022. (2) Returns are calculated on the basis of annual compounding. As it may be observed in Exhibit 2, the fund has outperformed in returns vis-à-vis its benchmark across all time frames. The returns of the fund in both modes (ie. Monthly and Lumpsum) across various time periods witnessed with mixed noticeable variations.

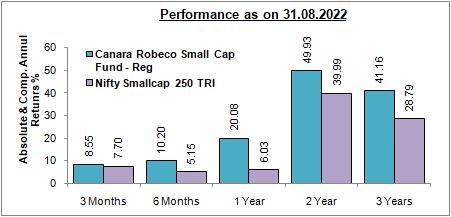

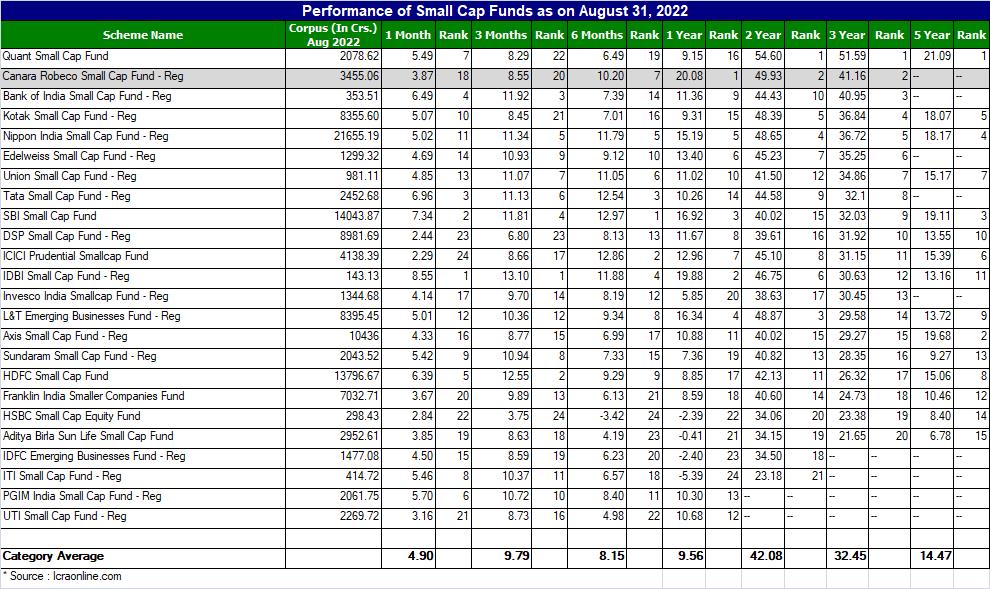

PERFORMANCE

In Exhibit 4, the scheme has outperformed the benchmark index in all the time horizons. The fund has not only topped the return chart in the one- and three- year periods, but it has also consistently performed in the recent volatile period. The scheme has given 20.08% returns in one year and 41.16% returns in three years. The benchmark of the scheme delivered 6.03% in one year, and 28.79% in three years. The category average for the corresponding period was 9.56% and 32.45% respectively. The fund always maintains cash position of around 2- 8 per cent even during periods of market upswing. The fund’s notable feature is that the fund has been able to perform in bear market despite lower cash levels in its portfolio. Considering the fund’s ability to contain downside better and consistent performance, Canara Robeco Small Cap Fund is suitable for investors who are looking to invest money for at least 3-4 years and looking for very high returns.

Please Note: The ratings mentioned in the report are declared by Value Research and Crisil has ranked 1 for this fund (For the quarter ended June 2022).

PEER COMPARISON

Start your Investment journey with us

Disclaimer - Mutual Fund investments are subject to market risks, read all scheme related documents carefully.