ICICI Pru Constant Maturity Gilt Fund

Date Published: November 20, 2023

FUND FACTS

|

Nature |

Open ended |

Fund Manager |

Anuj Tagra and Rohit Lakhotia |

|

Launch Date |

12-Sep-2014 |

Benchmark Index |

CRISIL 10 Yr Gilt Index |

|

NAV (Rs.) |

21.05 ( 31-Aug-2023 ) |

Corpus (Rs.in Crs.) |

2237.48 ( Aug-2023 ) |

|

Investment Objective |

To generate income primarily by investing in portfolio of Government Securities while maintaining Macaulay duration of the portfolio around 10 years. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. |

||

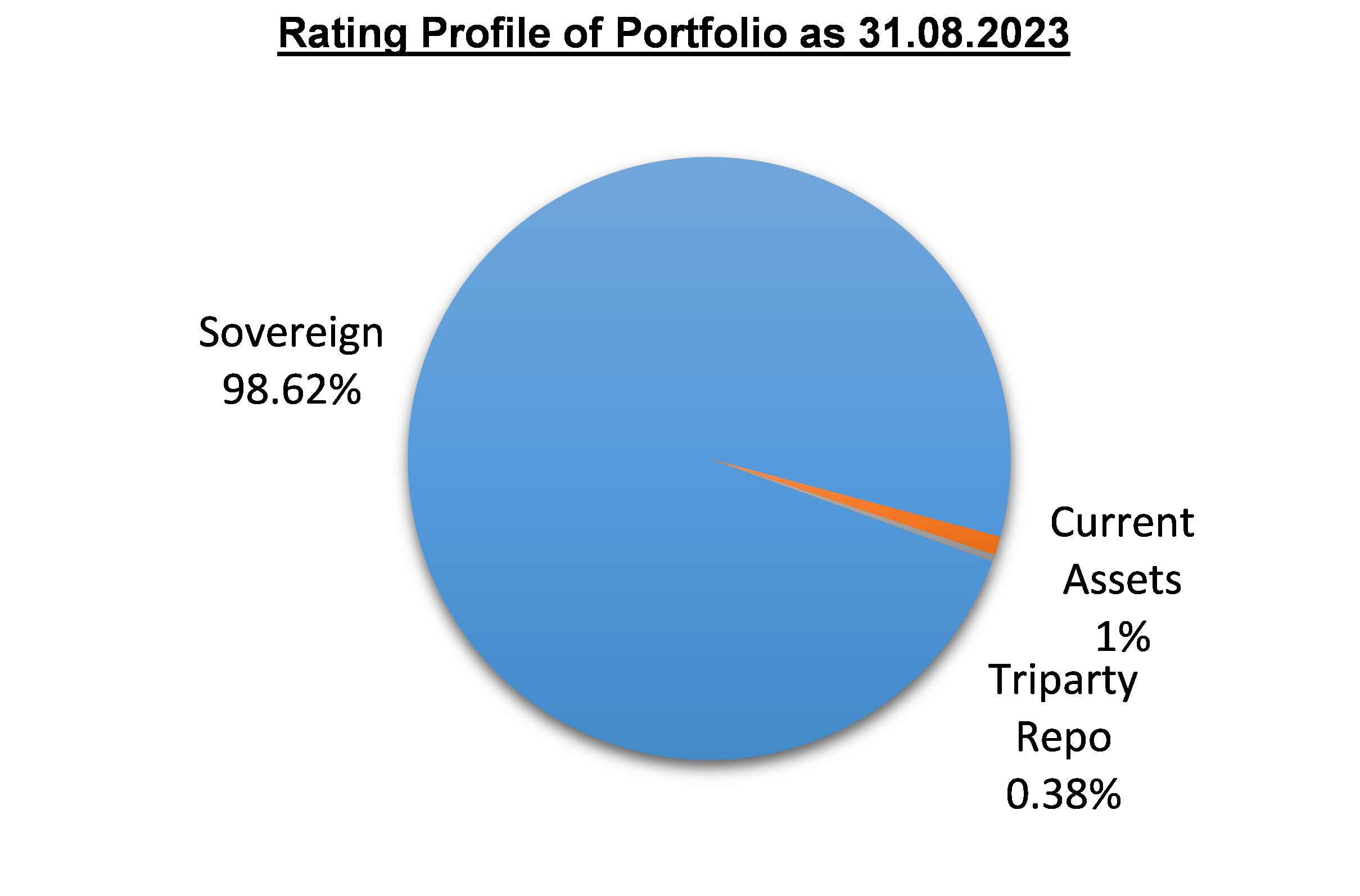

PORTFOLIO COMPOSITION

An open-ended Debt Scheme investing in government securities having a constant maturity of around 10 years. The fund has 98.62% of its net assets invested into debt, balance 1.38% in other instruments. It may be observed that the Quarterly Average AUM of the fund for the end of June 2023 is Rs. 528.82 crores.

| Table: 1 | |||||

|---|---|---|---|---|---|

| Top 10 Holdings (% in N.A) | Aug -23 | Ratings | |||

| 7.18 GOI Aug 14 2033 | 98.62 | Sovereign | |||

| Current Assets | 1 | ||||

| Triparty Repo | 0.38 | ||||

| Month End | Equity % | Debt % | Others % | Scheme % Returns |

|---|---|---|---|---|

| 31.08.2023 | - | 87.71 | 12.29 | 7.64 |

| 31.07.2023 | - | 96.21 | 3.79 | 1.71 |

| 30.06.2023 | - | 96.16 | 3.84 | -1.11 |

| 31.05.2023 | - | 97.01 | 2.99 | 15.95 |

| 28.04.2023 | - | 97.48 | 2.52 | 21.18 |

| 31.03.2023 | - | 103.08 | -3.08 | 17.69 |

| 28.02.2023 | - | 96.95 | 3.05 | 2.58 |

| 31.01.2023 | - | 95.29 | 4.71 | 4.42 |

| 30.12.2022 | - | 95.53 | 4.47 | 3.25 |

| 30.11.2022 | - | 95.85 | 4.15 | 15.47 |

| 31.10.2022 | - | 95.79 | 4.21 | 2.38 |

| 30.09.2022 | - | 96.66 | 3.34 | -10.88 |

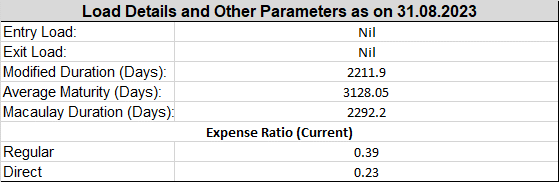

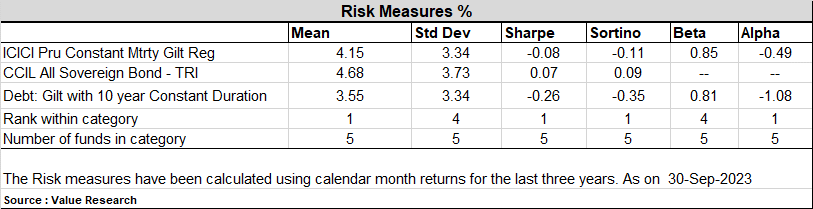

Risk of this scheme in terms of Standard deviation of monthly returns (using last 3 years data) is equal to the peer group of Debt: Gilt with 10 year Constant Duration, while the Sharpe ratio of this scheme is higher than the peer group of Debt: Gilt with 10 year Constant Duration.

Pls see the table called "Risk Measures (%) ".

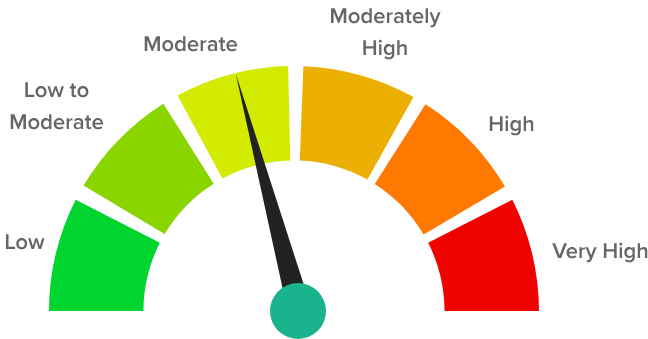

Riskometer

Level of Risk in the Scheme

Investors understand that their principal will be at Moderate risk

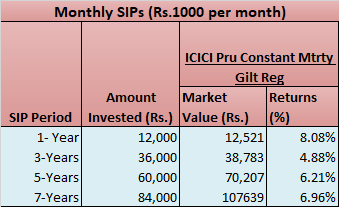

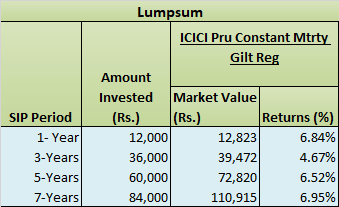

Monthly SIP and Lumpsum vis-à-vis Benchmark: Exhibit 2

Note: (1) Performance is on August 31, 2023. (2) Returns are calculated on the basis of annual compounding. The returns of the fund in both modes (ie. Monthly and Lumpsum) across various time periods witnessed with mixed noticeable variations.

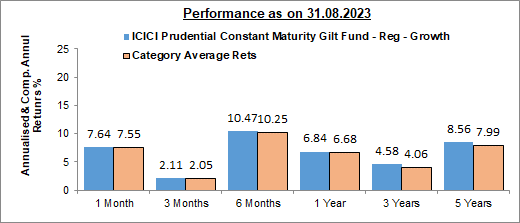

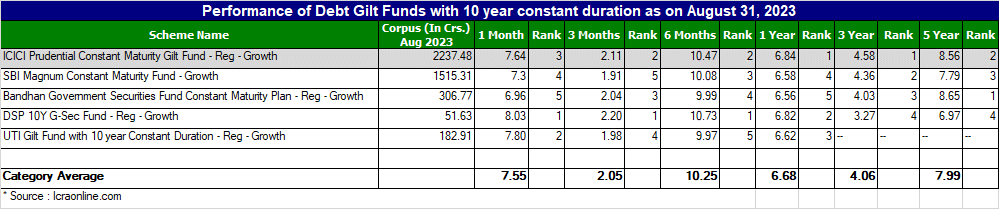

PERFORMANCE: In Exhibit 3, the scheme has outperformed the category average returns in all time horizon. Gilt debt funds invest in government securities of varying maturities. Returns primarily come from price appreciation on these instruments. Funds change portfolio maturities depending on the stage of the rate cycle and can go from very long term of over 10 years to short term. As gilts tend to be the most traded and reactive, returns may be volatile in the short term. Within gilt funds, some may be constant maturity funds where the portfolio maturity is maintained at 10 yrs. The scheme's ability to deliver returns consistently is in-line with most funds of its category. Its ability to control losses in a falling market is above average. The fund's top holdings are in GOI.

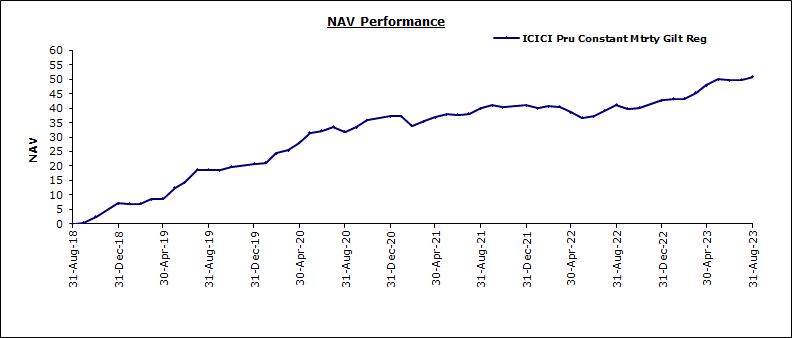

Nav Performance

PEER COMPARISON

Start your Investment journey with us

Disclaimer - Mutual Fund investments are subject to market risks, read all scheme related documents carefully.