Quant Mid Cap Fund

Date Published: March 7, 2024

FUND FACTS

|

Nature |

Open ended |

Fund Manager |

Ankit Pande | Vasav Sahgal/Sanjeev Sharma |

|

Date of Allotment/ Inception Date |

20 March 2001 |

Benchmark Index |

NIFTY MIDCAP 150 TRI |

|

NAV (Rs.) |

185.92 ( 28-Dec-2023 ) |

Corpus (Rs.in Crs.) |

3781.48 ( Nov-2023 ) |

|

Investment Objective |

The primary investment objective of the scheme is to seek to generate capital appreciation & provide long term growth opportunities by investing in a portfolio of Mid Cap companies. There is no assurance that the investment objective of the Scheme will be realized. |

||

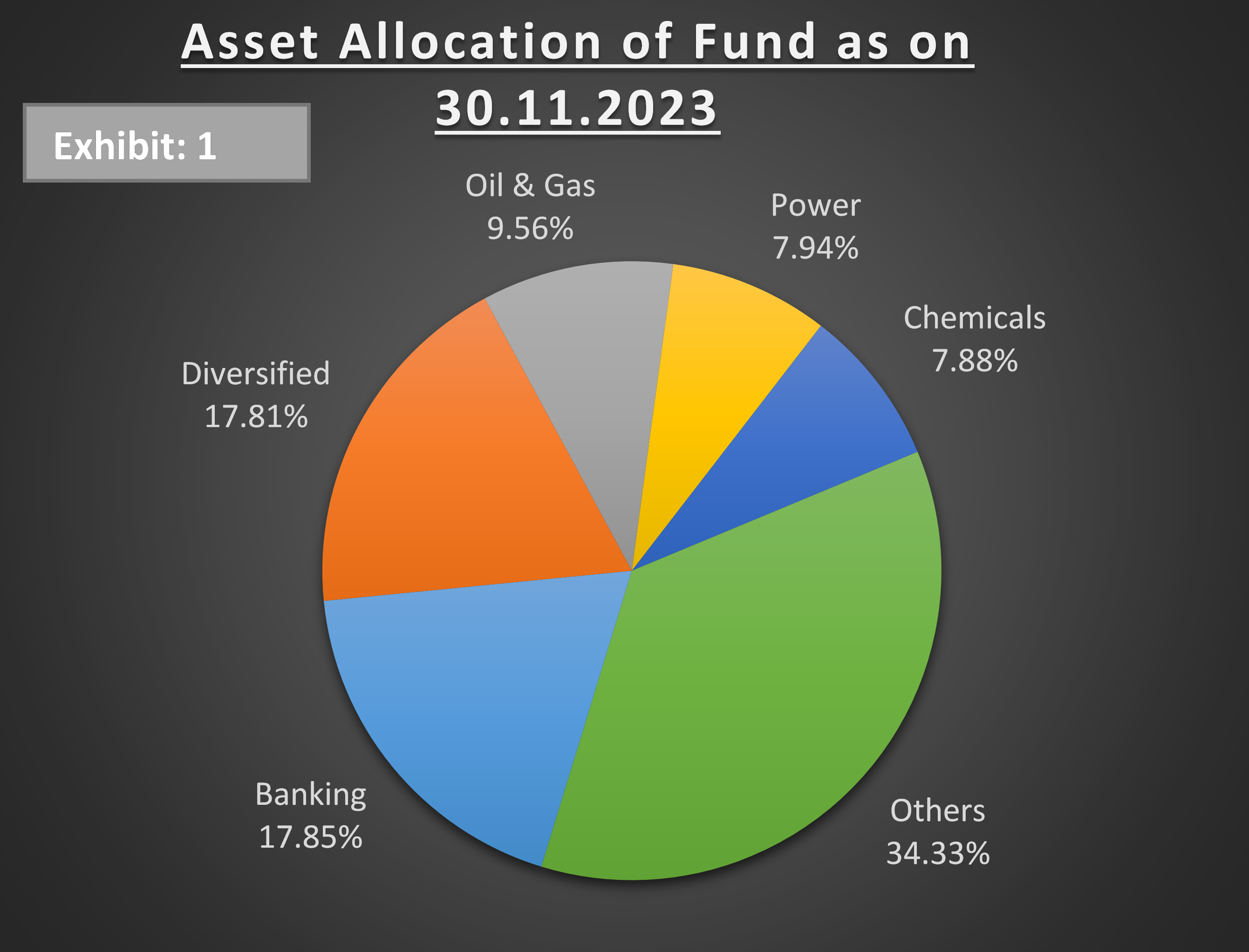

PORTFOLIO COMPOSITION

As of 30 Nov, 2023, the fund has 96.04% of its net assets invested into equity & equity related instruments and balance 3.96% in others. The large cap holdings constitute of 22.21% (market cap > Rs.49,687 crs), 62.30% in midcap (market cap > Rs.17,409 and < Rs. 49,687 crs) and 15.49% in other component. The top 10 holdings of the scheme constitute 55.48% of its net assets. It may be observed that the Quarterly Average AUM of the fund for the end of Dec 2023 is Rs.1406.29 crores.

| Sectoral Allocation (in %) as on 30.11.2023 | |

|---|---|

| Top 10 holdings of Fund (Table 1) | Fund Allocation |

| Banking | 17.85 |

| Diversified | 17.81 |

| Oil & Gas | 9.56 |

| Power | 7.94 |

| Chemicals | 7.88 |

| Capital Goods | 7.04 |

| Metals | 6.52 |

| Telecom | 6.02 |

| Consumer Durables | 5.98 |

| Media & Ent. | 2.87 |

| Month End | Equity % | Debt % | Cash % | Scheme % Returns (Monthly) | Category Avg% Returns (Monthly) |

|---|---|---|---|---|---|

| 30.11.2023 | 96.04 | - | 3.96 | 9.39 | 9.95 |

| 31.10.2023 | 97.40 | - | 2.60 | -3.20 | -3.67 |

| 29.09.2023 | 97.08 | - | 2.92 | 6.05 | 4.03 |

| 31.08.2023 | 89.17 | - | 10.83 | 0.82 | 4.03 |

| 31.07.2023 | 94.26 | - | 5.74 | 8.96 | 5.65 |

| 30.06.2023 | 90.51 | 2.74 | 6.75 | 5.69 | 6.69 |

| 31.05.2023 | 91.79 | - | 8.21 | 1.09 | 5.36 |

| 28.04.2023 | 98.15 | - | 1.85 | 8.46 | 7.94 |

| 31.03.2023 | 98.17 | 0.03 | 1.80 | -0.29 | -0.50 |

| 28.02.2023 | 93.66 | 0.03 | 6.31 | -1.45 | -0.17 |

| 31.01.2023 | 95.51 | 0.03 | 4.46 | -3.76 | -2.33 |

| 30.12.2022 | 97.56 | 0.04 | 2.40 | -0.26 | -1.72 |

| Top 10 Holdings (% in N.A) | Nov-23 | May-23 | Dec-22 |

|---|---|---|---|

| Linde India Ltd. | 7.88 | 4.24 | 5.06 |

| Reliance Industries Ltd. | 7.80 | 9.53 | - |

| NMDC Ltd. | 6.19 | - | - |

| Dixon Technologies (India) Ltd. | 5.98 | - | - |

| Lupin Ltd. | 5.29 | - | - |

| Punjab National Bank | 4.92 | 6.30 | |

| Poonawalla Fincorp Ltd. (Erstwhile Magma Fincorp Ltd.) | 4.91 | - | - |

| Aurobindo Pharma Ltd. | 4.27 | 4.77 | - |

| Adani Power Ltd. | 4.16 | - | - |

| Tata Communications Ltd. | 4.08 | 5.29 | 3.21 |

PORTFOLIO ANALYSIS

Quant Mid Cap Fund follows an active investment approach whereby it constantly hunts for attractive opportunities by focusing on 'buy on dips' strategy. The fund has a majority of its money invested in the top 5 sectors such as Banking, Diversified, Oil & Gas, Power, Chemicals. It stands among category toppers across long-term time frames and has outpaced the benchmark by a remarkable margin. The fund's strategy of timely identifying attractive-looking stocks and sectors and taking higher exposure in them has worked extremely well in its favour in the last few years, which helped it record extraordinary growth. Even over the shorter 1-year period, the fund has outpaced several of its peers, though it has trailed the benchmark. Its superior performance in the recent past has boosted its long-term returns as well.

Table 1 above tabulates the allocation of top 10 sectors by the fund. The fund has an allocation to 13 sectors, wherein the top 5 sectors constitutes to 61.04%. The fund could outperform its benchmark index in 06 out of 12 months during the last one year period, maintaining an average equity exposure of 94.94%.

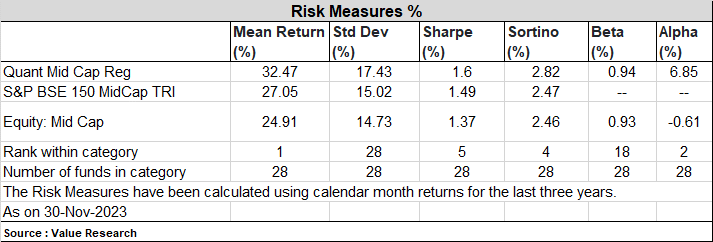

The risk parameter graph measures standard deviation (S.D.) across all the Midcap schemes. The S.D. of the scheme is 17.43%, which is lower than the industry average of the Midcap schemes of 24.91%. The Sharpe ratio of the scheme is 1.60%, which is higher than the industry average 1.37%.

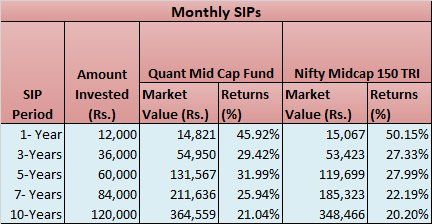

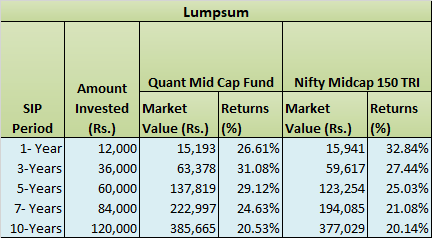

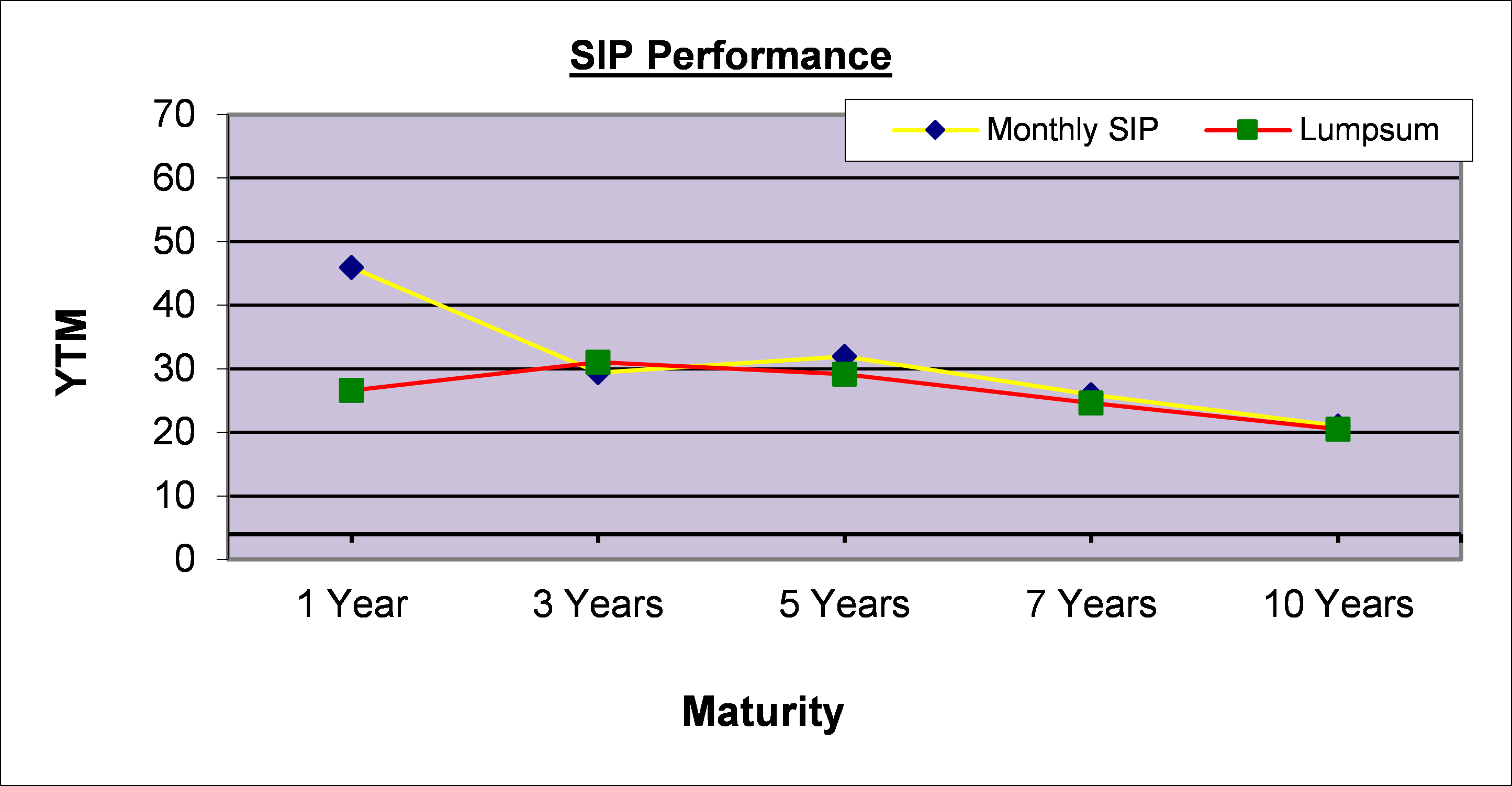

Monthly SIP and Lumpsum vis-à-vis Benchmark:

Note: (1) Performance is on November 30, 2023. (2) As it may be observed in Exhibit 2 that Other than the 1-year Time period, the fund has outperformed in returns vis-à-vis its benchmark across all time frames. The returns of the fund in both modes (ie. Monthly and Lumpsum) across various time periods witnessed with mixed noticeable variations.

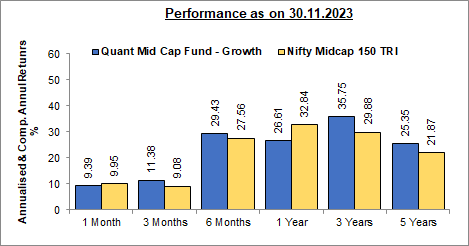

PERFORMANCE: In Exhibit 4, the scheme has outperformed its benchmark in all time horizons except for 1 month and 1 year horizon. In the past three- and five-year periods, the scheme has delivered 35.75 per cent and 25.35 per cent CAGR returns, while its benchmark, Nifty Midcap 150 TRI has given 29.88 per cent and 21.87 per cent CAGR returns in the same period, respectively. Quant Mid Cap Fund is a type of mutual fund that invests primarily in mid-sized companies with a market capitalization. The scheme's ability to deliver returns consistently is higher than most funds of its category. Its ability to control losses in a falling market is above average.

Quant Mid Cap Fund is suitable for aggressive investors looking for a momentum-driven Mid Cap Fund with an investment horizon of at least 5-7 years.

Please Note:The ratings mentioned in the report are declared by Value Research

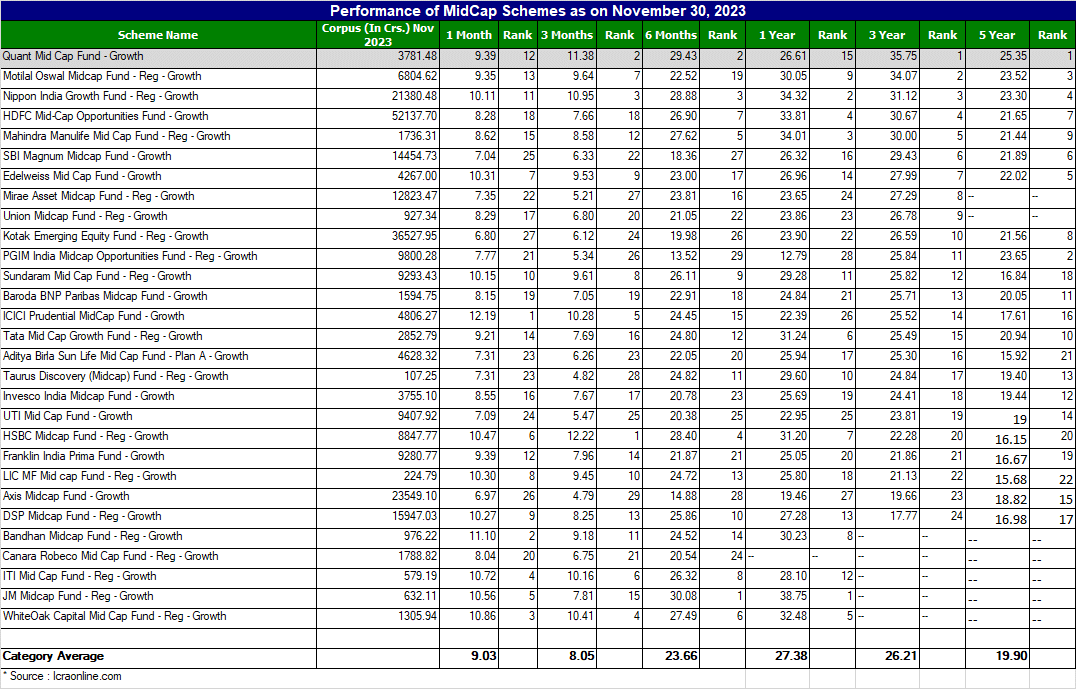

PEER COMPARISON

Start your Investment journey with us

Disclaimer - Mutual Fund investments are subject to market risks, read all scheme related documents carefully.