HDFC Mid-Cap Opportunities Fund

Date Published: August 8, 2023

FUND FACTS

|

Nature |

Open ended |

Fund Manager |

Chirag Setalvad |

|

Launch Date |

25-Jun-2007 |

Benchmark Index |

Nifty Midcap 150 TRI |

|

NAV (Rs.) |

110.31 ( 31-May-2023 ) |

Corpus (Rs.in Crs.) |

39295.71 ( May-2023 ) |

|

Investment Objective |

To provide long-term capital appreciation/income by investing predominantly in Mid-Cap companies. There is no assurance that the investment objective of the Scheme will be realized |

||

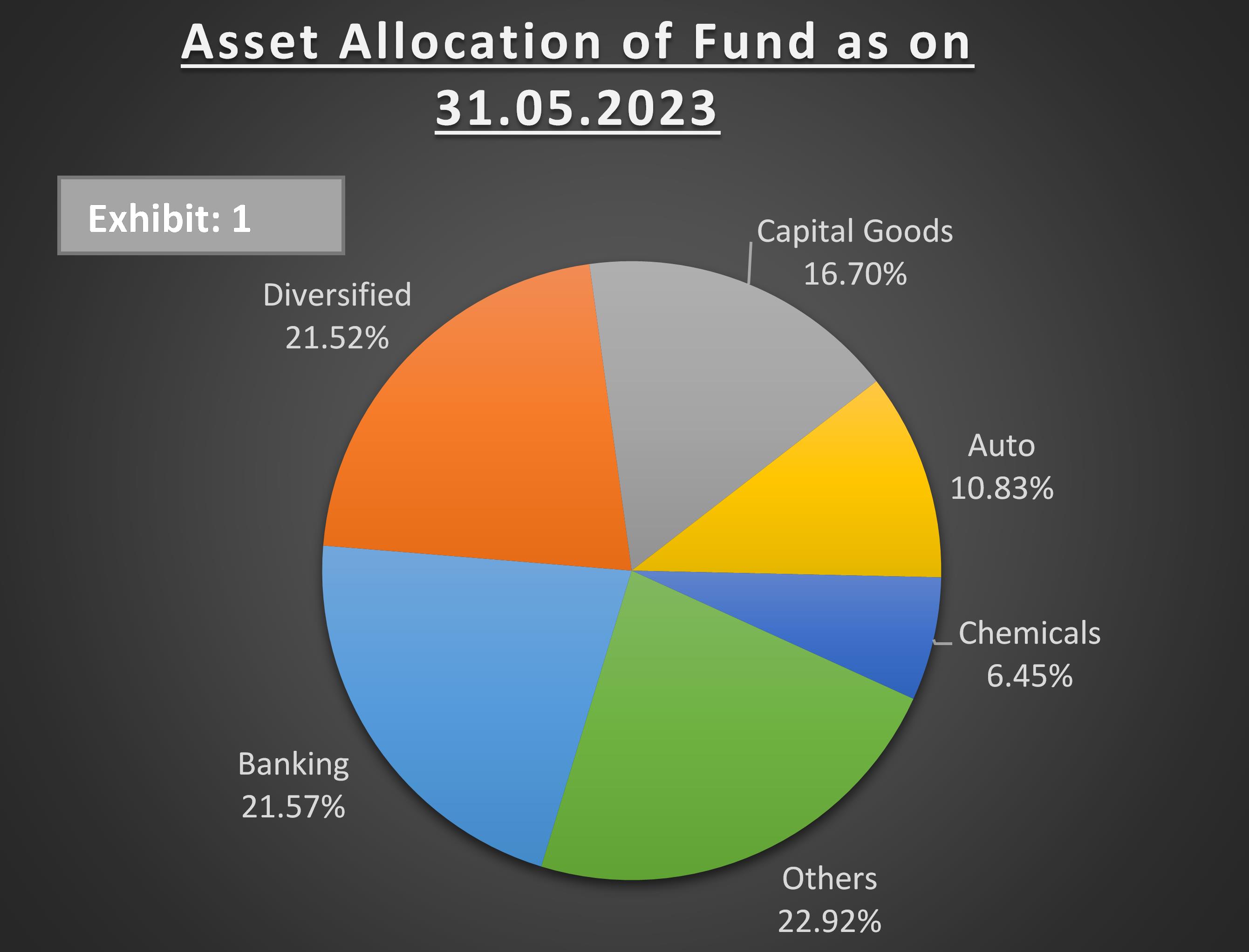

PORTFOLIO COMPOSITION

The fund has 93.94% of its net assets invested into equity & equity related instruments and balance 6.06% in cash and others. The large cap holdings constitute of 10.92% (market cap > Rs.48,898 crs), 66.54% in midcap (market cap > Rs.16,814 and < Rs. 48,898 crs), 16.26% in small cap (market cap 0 > Rs.16,814 crs), and balance 6.28% in debt and cash component. The top 10 holdings of the scheme constitute 34.77% of its net assets. It may be observed that the Quarterly Average AUM of the fund for the end of March 2023 is Rs.28340.38 crs.

| Sectoral Allocation (in %) as on 30.11.2022 | |

|---|---|

| Top 10 holdings of Fund (Table 1) | Fund Allocation |

| Banking | 21.57 |

| Diversified | 21.52 |

| Capital Goods | 16.70 |

| Auto | 10.83 |

| Chemicals | 6.45 |

| IT | 5.85 |

| Consumer Durables | 5.17 |

| Telecom | 3.06 |

| Metals | 1.97 |

| FMCG | 1.55 |

| Month End | Equity % | Cash % | Scheme % Returns (Month End) | Index% Returns |

|---|---|---|---|---|

| 31.05.2023 | 93.94 | 6.06 | 5.59 | 5.59 |

| 28.04.2023 | 93.44 | 6.56 | 7.03 | 7.94 |

| 31.03.2023 | 94.35 | 5.65 | -0.06 | -0.50 |

| 28.02.2023 | 94.44 | 5.56 | -0.14 | -0.17 |

| 31.01.2023 | 94.67 | 5.33 | -0.68 | -2.33 |

| 30.12.2022 | 95.54 | 4.46 | -1.20 | -1.72 |

| 30.11.2022 | 95.48 | 4.52 | 4.17 | 3.08 |

| 31.10.2022 | 96.66 | 3.34 | 2.69 | 1.84 |

| 30.09.2022 | 97.00 | 3.00 | -0.30 | -1.69 |

| 31.08.2022 | 97.77 | 2.23 | 5.39 | 5.94 |

| 29.07.2022 | 97.50 | 2.50 | 10.82 | 11.04 |

| 30.06.2022 | 96.00 | 4.00 | -4.11 | -5.20 |

| Top 10 Holdings (% in N.A) | May-23 | Nov-22 | June-22 |

|---|---|---|---|

| The Indian Hotels Company Ltd. | 5.16 | 4.62 | 4.54 |

| Hindustan Aeronautics Ltd. | 3.86 | 3.71 | 4.52 |

| Max Healthcare Institute Ltd. | 3.75 | 3.65 | 4.16 |

| Cholamandalam Investment & Finance Company Ltd. | 3.66 | 3.46 | 4.69 |

| Apollo Tyres Ltd. | 3.44 | 2.99 | 2.15 |

| Bharat Electronics Ltd. | 3.40 | 3.75 | 5.30 |

| Sundram Fasteners Ltd. | 3.16 | 3.33 | 3.24 |

| Tata Communications Ltd. | 3.06 | 3.20 | 1.86 |

| Balkrishna Industries Ltd | 2.83 | 2.77 | 3.62 |

| AIA Engineering Ltd. | 2.43 | 2.09 | 2.13 |

PORTFOLIO ANALYSIS

During the past one year, the fund manager has been constant with the number of scrips, thereby showing not a major changes in the portfolio broad based. The fund's top 5 holdings are in Indian Hotels Co. Ltd., Hindustan Aeronautics Ltd., Max Healthcare Institute Ltd., Cholamandalam Investment and Finance Company Ltd., Apollo Tyres Ltd. In the latest portfolio, the fund holds 63 scrips with around 66.54% invested in the midcap stocks only. This Fund aims to achieve long-term wealth creation. Also, the Fund holds a portfolio of mid-cap companies which have promising growth prospects, robust financial strength, sustainable business models, and attractive pricing that offers scope for value creation.

Table 1 above tabulates the allocation of top 10 sectors by the fund. The fund has an allocation to 14 sectors, wherein the top 5 sectors constitutes to 77.07%. The fund could outperform its benchmark index in 09 out of 12 months during the last one year period, maintaining an average equity exposure of 95.57%.

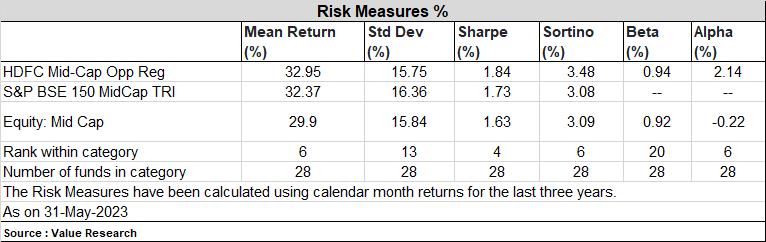

The risk parameter graph measures standard deviation (S.D.) across all the Multi Cap schemes. The S.D. of the scheme is 15.75%, which is higher than the industry average of the Mid Cap schemes of 15.84%. The Sharpe ratio of the scheme is 1.84%, which is higher than the industry average 1.63%.

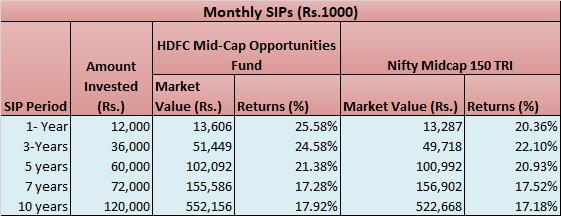

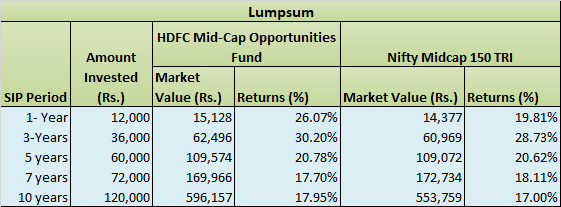

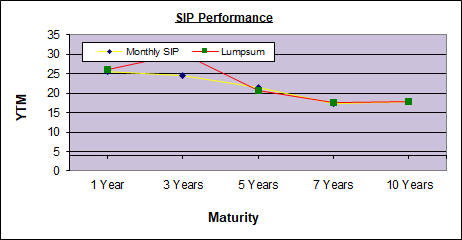

Monthly SIP and Lumpsum vis-à-vis Benchmark:

Note: (1) Performance is on May 31, 2023. (2) Returns are calculated on the basis of annual compounding.As it may be observed in Exhibit 2, the fund has outperformed in returns vis-à-vis its benchmark across all time frames. The returns of the fund in both modes (ie. Monthly and Lumpsum) across various time periods witnessed with mixed noticeable variations.

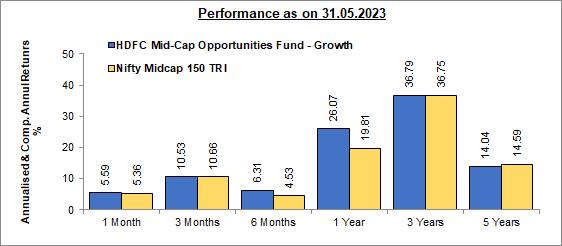

PERFORMANCE: In Exhibit 4, the scheme has outperformed the benchmark index in 1 and 6 months and 1 and 3 years horizons. The fund has also outperformed its category average in all time horizon. It posted annualized returns of 19.91 per cent for 10 years against the benchmark's 19.00 per cent. The fund has a sound track record of delivering healthy returns over the long run. The fund has the majority of its money invested in Financial, Capital Goods, Services, Healthcare, Automobile sectors. Over the last 1-year period, the fund has registered a return of around 26.07%, as against 19.81% delivered by its benchmark Nifty Midcap 150 TRI index. Clearly, fund’s recent extra-ordinary performance, supported by its ability to manage downsides, helped it find a space in the list of top category performers. With this the fund has achieved a mark of significantly outpacing the benchmark and prominent category peers across time periods.

Please Note:The ratings mentioned in the report are declared by Value Research

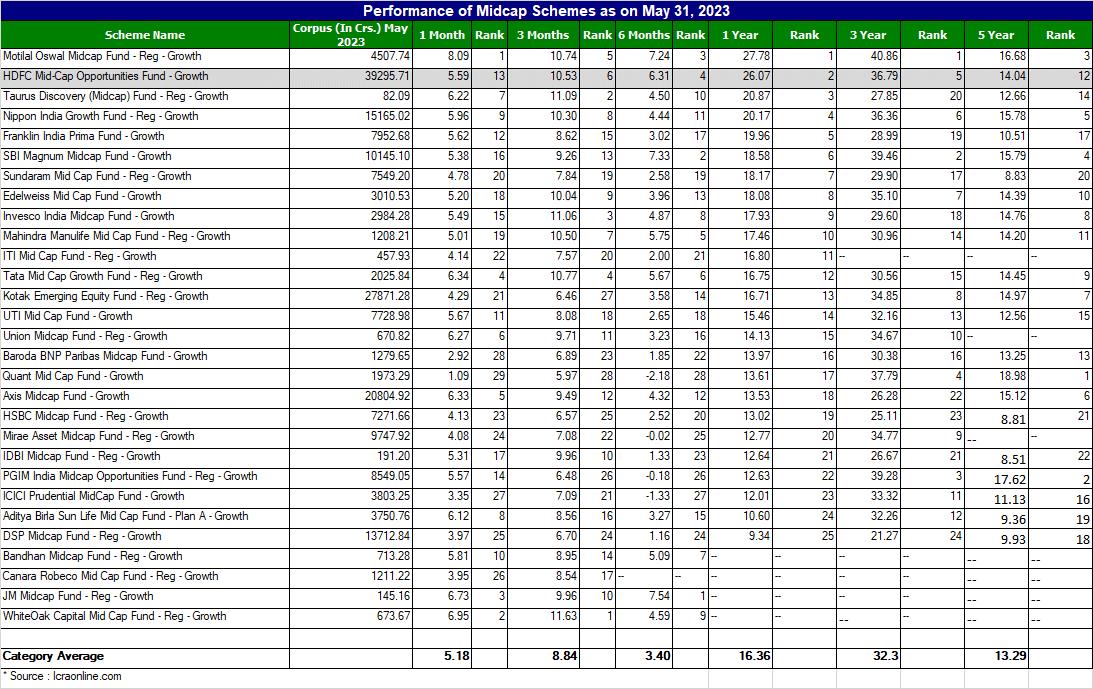

PEER COMPARISON

Start your Investment journey with us

Disclaimer - Mutual Fund investments are subject to market risks, read all scheme related documents carefully.