INSURANCE SECTOR

Date Published: November 15, 2022

Sector Overview:

Insurance sector is one of an important industry in Indian economic system. It increases the opportunities of savings for people, protect their future and garner massive funds for further invested in the capital market. In India insurance came in 1818 with the establishment of the Oriental Life Insurance Company in Calcutta. The insurance industry is categorized into life insurance and general insurance, which are further sub categorized. Insurance Regulatory Authority of India (IRDAI) is the formal authority in India to regulate the insurance sector. At the end of March 2021, there were 68 insurers operating in India; of which 24 are life insurers and 44 general insurance companies (including including reinsurers and foreign reinsurers’ branches).

SUMMARY:

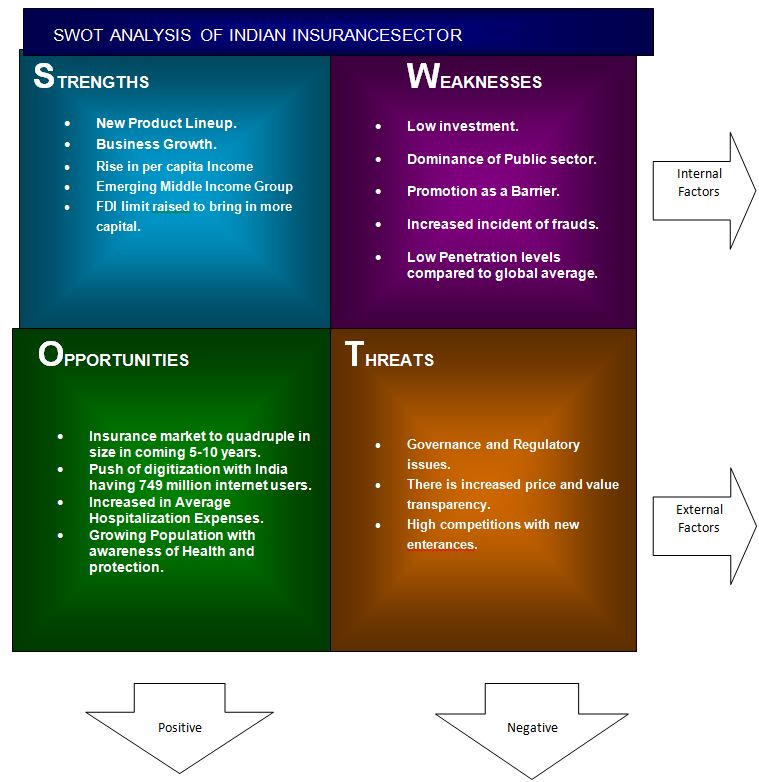

Exhibit: 1

Sector Overview:

Entry Mode:

Since the formal inception of insurance sector in India, many major changes have been done by the government and IRDAI for fostering the growth of sector with presence of effective competition. In December 2014, the government approved increasing the FDI limit in the insurance sector from 26% to 49%. In the Union Budget FY2021-22, the government raised the industry’s FDI cap from 49% to 74%. The General Insurance Amendment Bill was padded in August 2021, which aims to push greater private participation in the public sector insurers. The bill seeks to remove the requirement that the Centre should hold not less than 51 per cent of the equity capital in such insurers. India’s insurance industry has registered an impressive growth rate over the last two decades owing to the increasing participation of the private sector.

Segment Opportunities:

Amid the peak COVID-19 period and post it, many insurance companies, themselves and on the advice of IRDAI have been rapidly introducing the new-age products and services considering the changing risk scenarios. The companies are taking the advantage of artificial intelligence, machine learning and block chain to enhance risk modelling and deliver value added services with speed, convenience and comfort to the customers. Given that insurance penetration in the country is still very low, the potential of further expansion and development of insurance sector in India looks promising for all the sub-sectors. Ease of tracking, relatively low-cost structure over time and the convenience of adding a rider or top-up are becoming the major reasons for youth preferring Unit Linked Insurance Policies lately.

Government Policy:

The government of India has continuously worked towards providing quality healthcare and health coverage for its citizens. The government regularly conducts activities such as creating awareness, ensuring infrastructure and promoting health insurance in the country, especially in rural and backward areas. During COVID times, the government has announced various favorable measures in regard to extension of date of payment of insurance premiums by the people, so as to facilitate people for effectively and continuously cover their risks in uncertain time caused by pandemic.

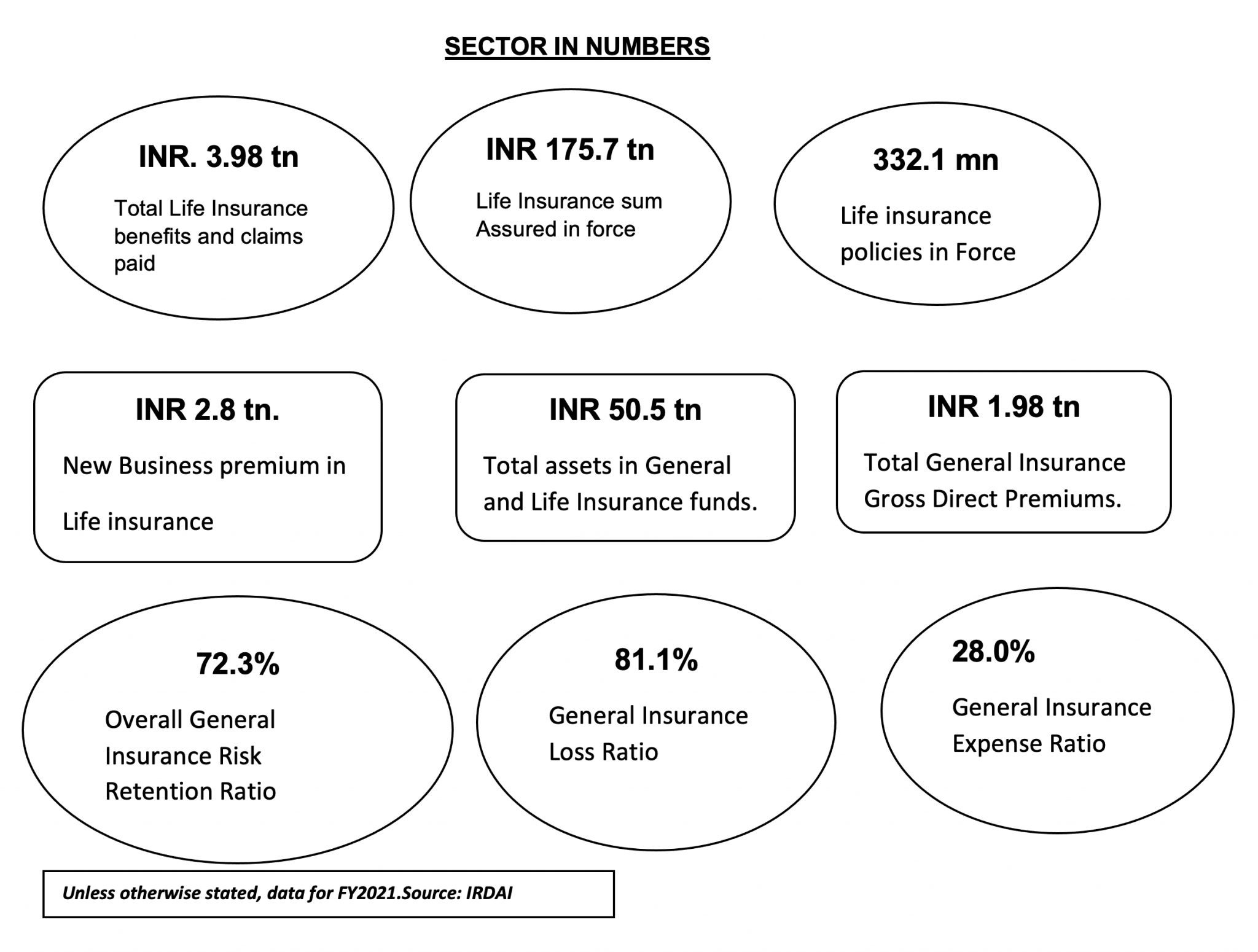

Sector Snapshot India Insurance FY2021:

The opening of the sector began in 1990s and last two decades have witnessed a massive transformation of insurance industry in India, both in terms of competition, presence of private players and variety of insurance products. As of the end of FY2021, there were 24 life insurers, 44 general insurers and reinsurers (including specialised insurers, standalone health insurers and foreign reinsurers’ branches) in India. India’s insurance market share is majorly held by the public sector companies, even though their share has been declining over the years.

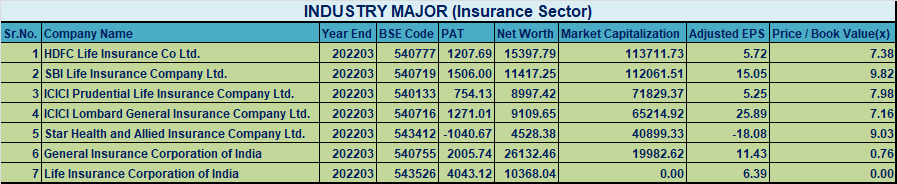

According to IRDA, the India’s life insurance business is ranked tenth in the world with very less insurance penetration. The life insurance penetration in India was registered at 3.2% in FY2021, while the life insurance density in India was at US$ 59 in 2020-21. This indicates that the life insurance in India has a huge growth potential. During FY2021, the life insurance industry recorded a net premium of INR 6.3tn, marking a yoy growth of 9.6%. In FY2021, share of private sector in life insurance in India stood 35.86% and LIC accounted for rest of 64.14% share, with respect to the total life insurance premium.

There is one reinsurance company, the General Insurance Corporation of India (GIC Re) in the public sector as well as 10 reinsurers including foreign reinsurers’ branches and Lloyd’s India in the private sector. The net earned premium of the Reinsurer during FY2021 was decreased to INR 398bn from INR 441bn in FY2020. The net incurred claim ratio has decreased to 92.4% in FY2021 from 97.5% in FY2020. As on March 31, 2021, there are 10 Foreign Reinsurance Branches operating in India. Brokerage is one of the popular methods of getting insurance policies in India as it saves people’s time and money and results in better coverage, comprising of 16.6% share in total new business premium in life insurance market.

Driving Forces:

Before COVID times also, India remained one of the most potential filled market for insurance. The demographic factors such as rising population, high share of young people, along with rising disposable income and urbanization have been supportive factors for the further growth and expansion of insurance market in India. Also the strong economic fundamentals and good economic scenario have been tailwinds for foreign players investing in India. Apart from this, COVID has increased the importance of risk coverage among people and made them more responsive in this direction.

External:

The later part of FY2021 witnessed the unlocking of economic activities, thereby driving the economic growth rate of India. India remained one of the countries on whom the economic impact of COVID has been relatively minimal with great support of the government and RBI and wide vaccination drive in the country. Apart from COVID related favourable gain to insurance sector in form of increased awareness and sense of security in investing into insurance, the increasing disposable income of people over the years has raised the demand for insurance products. It has been estimated that India will add 140mn middle-income and 21mn high-income households by 2030, which will drive the demand for insurance products. Also the target market size of the insurance sector is very high in India given the low penetration of insurance, especially in rural areas. Further, as of 2020, 68% of India’s population is young and 55% of its population is in the age group of 20-59 and is estimated to reach 56% of the total population by 2025. These point towards a young insurable population in India.

Internal:

The government has been very supportive in increasing the presence of private players into the economy and insurance sector is no exception. The favourable policies, enhanced ease of doing business, easier norms, liberal FDI limits, among others have attracted private players, both domestic and foreign into the insurance market of India. The onset of the Coronavirus pandemic have brought about a conscious shift in the insurance product mix. Companies rapidly came up with Corona-specific insurance plans. For instance, insurance companies launched Corona Kavach and Corona Rakshak to cover the cost of COVID-19 treatment and comorbid conditions. Amid COVID scenario, IRDAI took efforts to bring insurance products and services within the maximum reach of consumers in the most convenient way possible by allowing them to take approval of customers through e-KYC and video KYC to issue them a policy, in place of submitting physical documents.(Source: IBEF, Business Today, Company reports)

Sector Outlook:

Though the 3 rd wave of COVID-19 with new variants started in January 2022, it had far been less severe than the prior waves. Following the preventive measures of the Government including micro level restrictions, the contact-intensive services are temporarily impacted, industrial activity remains robust supported by government spending and healthy global demand.

The GDP growth rate for Q4 FY 2022 stood at 4.1% as compared to 5.4% in Q3, 8.4% in Q2 and 20.1% in Q1 FY 2022. The GDP growth rate for FY 2021-22 stood at 8.7%. This overall growth rate has been a good indicator given the challenges, such as the impact of different variants of COVID-19 as well as the high commodity prices, faced by the economy during the year. Further, according to IMF estimates (April 2022), India’s economy is estimated to grow by 8.2% in FY 2023.

The pandemic has increased the insurance penetration rate and triggered awareness on insurance and demand for protection products, especially health insurance. However, still the penetration rate in the country is very low, therefore, Indian insurance market has a bright future with huge potential to grow in the country with massive untapped population. Some of the favourable factors that would drive the insurance demand in India are country’s young demographic, increasing per capita income, increasing awareness, rapid urbanization, among others.Digital disintermediation is proceeding strongly in the Indian insurance industry. The number of startups offering online insurance has grown, backed by the huge start-ups funding companies being interested in investing in India.

The short and medium term growth in the insurance sector will be driven by the increasing number of insurance providers with various sophisticated products at competitive prices. The companies are rapidly introducing the new-age products and services considering the changing risk scenarios and perforce of the people. Further, the companies are today increasingly adopting advanced digital technologies like artificial intelligence, machine learning and block chain to enhance risk modelling and deliver value added services with speed, convenience and comfort to the customers.

(Source: IRDAI, Economic Times, Livemint, The Hindu)

Online Insurance, Market in India 2022:

Exhibit-2

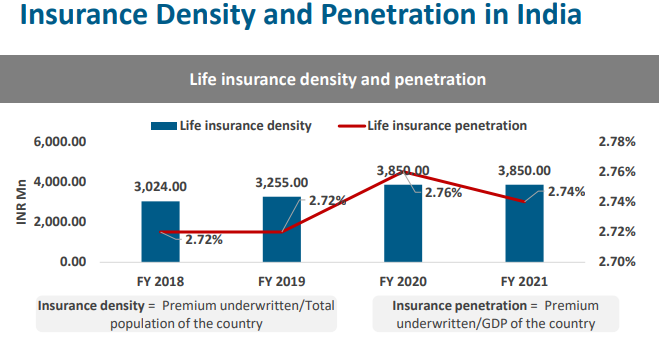

Insurance Density and Penetration in India:

- Increasing insurance density is an indicator of growth and development of the insurance sector

- The life insurance density in India increased from INR 2,870.00 in FY 2016 to INR 3,850.00 in FY 2021

- Life insurance penetration in India stood at ~2.74% in FY 2021

- No significant change in the penetration percentage has been observed in the past decade

- In FY 2022, LIC achieved a record first-year premium income of INR 1,987.59 Bn under the individual assurance business, representing a 7.92% increase over the previous year.

Exhibit-3

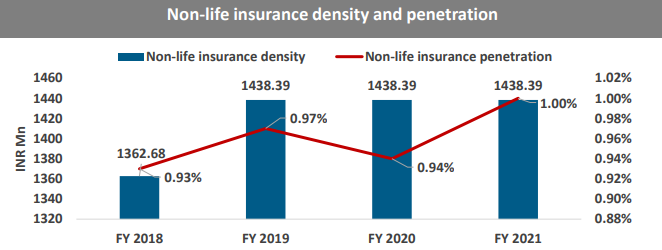

Non-life insurance density and penetration:

- In FY 2021, non-life insurance density in India stood at INR 1438.39

- The penetration of non-life insurance in the country is very low. In FY 2021, it stood at ~1.00%, compared to the global average of 5.7%

- Life insurance penetration in India stood at ~2.74% in FY 2021

- No significant change in the penetration percentage has been observed in the past decade

- Gross premiums written by non-life insurers in India increased to INR 2096.71 Bn in FY 2022, up from INR 1880.79, Bn in FY 2022, due to solid growth from general insurance companies

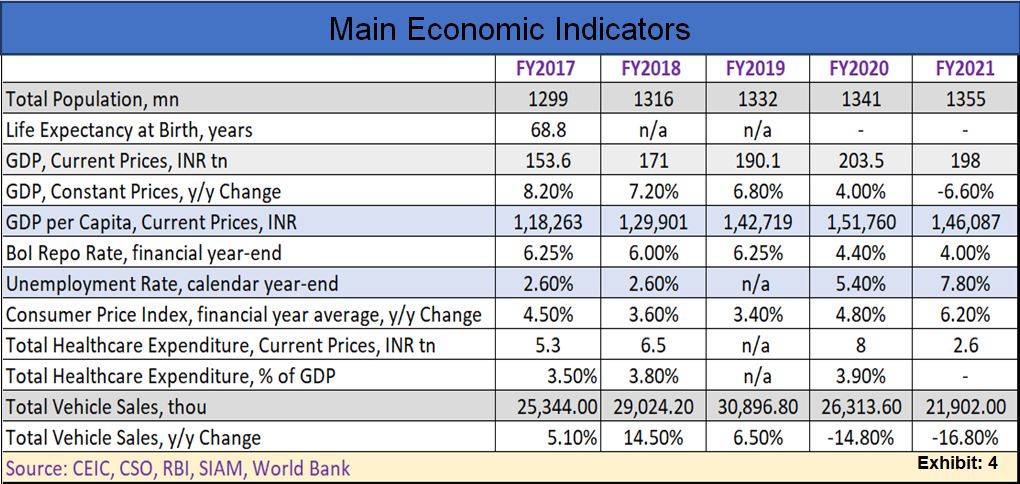

Population and Life Expectancy:

India is the second most populous country of the world with the population of 1369mn people as of FY2022. According to United Nation research, India’s population is expected to reach 1,668mn by 2050, far exceeding China’s declining population at 1,317mn. Around 40% of population of India lives in urban areas, who is experiencing increased standard of living and rising disposable income. Further, Indian demographic profile indicates presence of high youth population. All these factors bodes well with the demand creation for insurance sector. Moreover, the rising awareness in rural areas, credit of which could be given to both government and industry initiatives, further expands the market for insurance. The potential for extension of penetration of both life as well as general insurance in India is huge. In FY2021, the unprecedented crises and fear created by the COVID-19 has increased the awareness and importance of insurance among the people.

Healthcare Expenditure:

Total healthcare expenditure in India stood at INR 8.0tn in FY2020, which is around 3.94% of GDP. The government and the private sector both play significant roles in delivering healthcare to Indian citizens and medical tourists. The global coronavirus pandemic has driven the Indian government to increase healthcare and insurance provision and stimulated policy changes for the pharmaceutical sector. In September 2018 the government launched the ambitious Pradhan Mantri Jan Arogya Yojana (PMJAY or AB-PMJAY), the world’s largest government-funded healthcare programme, which aims to cover 40% of the population. By July 2021 e-cards had been issued to 160.7m people (around 12% of the population) under the PMJAY and allied state schemes. The budget for 2021/22, presented in February 2021, raised allocations for health and wellbeing by 137%, to INR 2.2tn (US$ 29.6bn), although this includes allocations for ancillary areas such as sanitation and drinking water. Of this, INR 64bn (US$ 862mn) was allotted to the PMJAY, as in the previous two years.

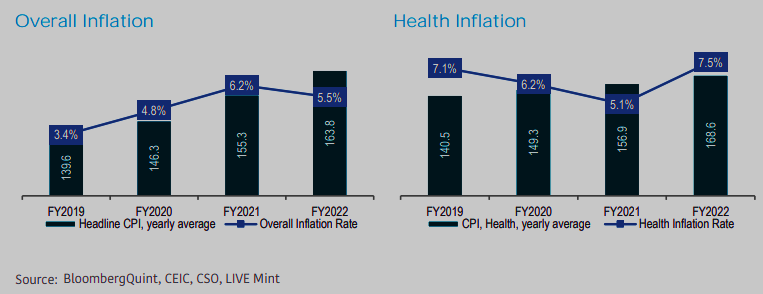

Inflation:

The CPI measures retail inflation in India by revealing changes in the prices of a basket of goods and services. Food is a major component of CPI inflation and therefore the CPI in India significantly depends upon weather conditions and supply side factors. From increasing to the level of 6.2% in FY2021 from 4.8%in FY2020, the CPI inflation decreased again in FY2022 to 5.5%. As after the residing of COVID-19 in the country, the supply side constraints eased and demand and supply balance improved in the economy. However, on front of the health inflation, India experienced a rise in FY2022 to the level of 7.2% from 5.1% in FY2021. which was 2.8% in April 2020 spiked to 7.7% in April 2021 and 8.4% in May 2021. This increase in medical expenditure is expected to drive the awareness among the people of buying an insurance policy.

Government Policy:

Increase in FDI limits:

In March 2016, the Indian Insurance Companies (Foreign Investment) Amendment Rules, 2016, were adopted to enable FDI through an automatic route. This removed the requirement of going through the government for foreign investment beyond 26% and up to 49%. In February 2020, the government further amended its FDI policy and allowed 100% FDI for insurance intermediaries (insurance broking, insurance companies, third party administrators, surveyors and loss assessors). The Union Budget FY2021-22 has something to cheer for insurance players since it has raised the industry’s FDI cap from 49 per cent to 74 per cent.

Government Schemes and Programmes and Interventions during COVID-19:

The government of India has continuously worked towards providing quality healthcare and health coverage for its citizens. The government regularly conducts activities such as creating awareness, ensuring infrastructure and promoting health insurance in the country, especially in rural and backward areas. The major insurance related schemes or initiatives of the government include Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY); Pradhan Mantri Suraksha Bima Yojana (PMSBY); Life Cover under Pradhan Mantri Jan Dhan Yojana (PMJDY); Varishtha Pension Bima Yojana; Pradhan Mantri Fasal Bima Yojana (PMFBY); Pradhan Mantri Vaya Vandana Yojana (PMVVY); and the Restructured Weather Based Crop Insurance Scheme (RWBCIS), among others. On December 26, 2020, the Prime Minister, Mr. Narendra Modi launched the ‘Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) SEHAT’ scheme to extend health insurance coverage to all residents of Jammu and Kashmir. In June 2021, the government extended a INR 5mn (US$ 66.85thou) insurance coverage scheme for healthcare workers across India until the next one year. In December 2020, Uttarakhand announced its plan to offer ‘COVID-19 Insurance Policy’ to international tourists. The General Insurance Business (Nationalisation) Amendment Bill, 2021 was passed by the Rajya Sabha on August 11, 2021. The Lok Sabha had already passed it on August 3, 2021. The General InsuranceAmendment Bill aims to push greater private participation in the public sector insurers. The bill seeks to remove the requirement that the Centre should hold not less than 51 per cent of the equity capital in such insurers. In April 2022, IRDAI allowed insurance companies to invest in debt securities of Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs).

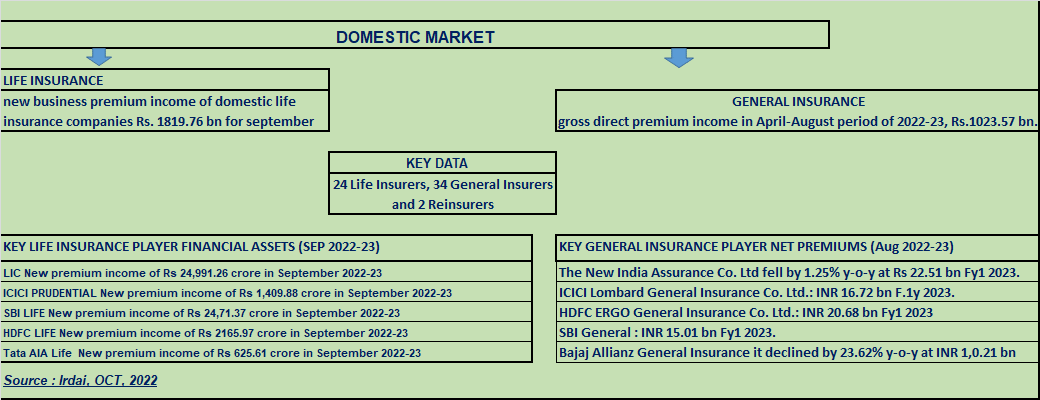

New Business:

The Insurance Regulatory and Development Authority of India (Irdai) in its latest data has showed that the new business premium income of domestic life insurance companies rose by 17.3 per cent to Rs 36,366.53 crore in September of this fiscal year. All the 24 life insurance companies had a collective premium income of Rs 31,001.17 crore in the same period a year ago. The largest and the only state-owned insurer LIC recorded a jump of nearly 35 per cent in the new premium income of Rs 24,991.26 crore in September 2022-23, as against Rs 18,520.21 crore in same period of 2021-22.

However, the rest of the 23 players in the private sector witnessed a decline of 8.9 per cent in their combined new premium income during the reported month at Rs 11,375.27 crore as against Rs 12,480.96 crore a year ago. Among the private sector players: SBI Life registered a fall of 15 per cent in new premium income at Rs 2,471.37 crore; HDFC Life down by 22.3 per cent at Rs 2,165.97 crore; Bajaj Allianz Life at Rs 670.43 crore, down by 38.2 per cent; and ICICI Prudential Life down by 4 per cent at Rs 1,409.88 crore. Among others, Max Life witnessed a rise of 3.14 per cent at Rs 706.66 crore; PNB MetLife premium was up by 45.3 per cent at Rs 300.62 crore; Tata AIA Life up 39 per cent at Rs 625.61 crore and Aviva Life up 11.3 per cent at Rs 25.71 crore.

On a cumulative basis from April-September period of 2022-23, the new business premium of all the 24 life insurers moved up by 37.88 per cent at Rs 1,81,976.96 crore. It was at Rs 1,31,981.89 crore in same period of 2021-22. For LIC, the cumulative new business premium during the first half ended September of the current fiscal year was up by 45.91 per cent at Rs 1,24,191.08 crore. All the private sector players reported a rise of 23.3 per cent in their combined cumulative new premium income during April-September period of FY23 at Rs 57,785.88 crore.

Source: (IRDAI dated 12-Oct-2022.)

Risk Retention:

The retention ratio measures how much of the premium the company received was retained rather than passed on. The overall retention ratio of the general insurance industry of India continued to grow in FY2021 as well to 72.3% as compared to 69.8% in FY2020 and 59.8% in FY2019. Despite the overall industry retention rate increase, the same for engineering and aviation segment fell in FY2021 as compared to the previous year of FY2020.

RETAIL CHANNELS:

Brokerage:

An insurance broker works and helps people to identify and put together the best possible insurance plan according to their specific coverage needs. Usually, brokers do not have obligation to sell policies from one insurance company or another, rather, they compare and choose from diverse products offered by the different insurance companies and find the best policies at the best prices according to their clients’ needs. Brokerage is one of the popular methods of getting insurance policies in India as as it saves people’s time and money and results in better coverage. Although, brokers have a better coverage and penetration in urban areas and semi-urban areas, however, their penetration is still low in rural areas. The total new business in the life insurance subsector from the brokerage channel has increased at a CAGR of 12.35% over the period FY2017-FY2021 reaching to the level of INR 31.5bn in FY2021, comprising of 16.6% share in total new business premium in life insurance market. Brokerage channel held 28.3% share in the general insurance premium in FY2021. Brokers have been playing a very important role in the general insurance business and they have been a preferred source as they are believed to provide better support in claim settlement by like car dealers and hospitals.

Agency:

Agent channel of insurance has also been a popular and most traditional channel for distributing insurance policies. An Insurance Agent works by selling, negotiating, or promoting insurance products/ policies on behalf of their employer organization. Through this, they act as the sales representatives for the company. The rapidly adoption of digitalisation, which has also been boosted by the COVID situation, the people prefer to opt various services online. Also, online selling or promoting insurance policies have become a viable option for the companies. Due to this the agent channel has been affected significantly. The total number of life insurance agents have increased at a CAGR of 3.1% reaching to the total number of 2.45mn in FY2021 from 2 mn in FY2017.

Bancassurance:

Bancassurance has not been a much older concept in India as compared to brokerage or agent channels. In this type of insurance distribution channel, a bank sells the insurance policies of a particular insurer. The banks were allowed by IRDAI to act as corporate agents in 2002. Over the years, the bancassurance channel has developed in India owing as in the process of depositing funds in financial institutions through bancassurance, customers benefit from reduced premium prices, high quality product, and delivery. Further, reliance of banks on advanced digital capabilities, promotional activities and features of new insurance policies have resulted into more partnershipswith insurance players. After the pandemic COVID decline, the people are still preferring online mode. At this juncture, leveraging is required for pre-Covid Bancassurance services with newly digitized insurance sales channelsto reach out to relevant customers, according to various industry experts.

Direct Selling:

Especially during and after (times of minimal effect) COVID times, the popularity of direct selling has been on rise owing to numerous online purchase options, including social media and mobile-based payment applications along with growing smartphone and internet penetration. Direct selling has been a dominant channel of distribution for group business of life insurers, with a share of around 91% of premiums during FY2021. Over the years, in the general insurance market segment, the direct sales channel has been on the rise and is set to beat the traditional dominance of brokers and agents. However, the gross direct premiums through direct sales has registered a decline in FY2021 of 8.1% to mark the level of INR 361.6bn.

Health and Motor Continue to Drive Growth in Non-Life Insurance:

Overview:

After over 20% growth in Q1 FY23, the non-life insurance industry registered a growth of 16% and 11.9% in July and August, respectively. In the year-to-date period, the industry has grown 18.6%, compared to 17.4% in the same period last year. This growth is driven by health (especially the group segment), motor, and crop insurance.

Movement in Gross Direct Premium Underwritten:

General Insurers’ August 2022 numbers were up at a slower 9.3% vs 17.9% a year ago, while for the first five months of FY23, the growth has been more than 1.3x that was witnessed last year driven by the health and motor segments.

Standalone Private Health Insurers (SAHI) have continued their growth trajectory as August 2022 numbers reached Rs2,059.4 crore, up from Rs 1,609.8 crore in August 2021, moreover this monthly growth was higher than the 25.8% growth reported in August 2021. On the other hand, the year-to-date growth rate was slower in the current year vs. last year. This slowing growth was on account of the normalized growth in the government health schemes in the current year, while last year, the same had posted significant growth.

Specialized insurers posted a significantly slower increase of 15.2% in August 2022 after reporting an increase of 52.5% in August 2021. The growth can primarily be attributed to a rise in crop insurance and ECGC premiums

(Source: General Insurance Council, IRDAI)

Insurance companies road ahead:

Shifting of Technology is must for insurance companies and sector as a whole, shifting their focus from basic operational transformation—such as transitioning to cloud—to fully realizing the value and benefits of infrastructure and technological upgrades; move from responding to the requirements of regulators and other industry overseers to more proactively anticipating and fulfilling distributor and policyholder expectations; and broaden their historical focus from risk and cost reduction to prioritize greater levels of experimentation and risk-taking that drives ongoing innovation, competitive differentiation, and profitable growth.Over the last few years, most insurance carriers have demonstrated remarkable flexibility and resilience in overcoming a host of obstacles, especially the impact of the pandemic and the economic fallout from the Russia-Ukraine conflict. Systems and capabilities were improved, while agile talent and technology strategies paid off. But is the industry ready for emerging challenges heading into 2023 (and beyond)? The road ahead is dotted with multiple hurdles—rising inflation, interest rates, and loss costs; the looming threats of recession, climate change, and geopolitical upheaval; and competition from InsurTechs and even noninsurance entities such as e-tailers and manufacturers, to name a few. This is no time for carriers to be satisfied with the adaptations they’ve had to make.

Source: ACE Equity data.