How SIPs work to your advantage even During Market Correction

Date Published: March 21, 2023

Several investors who began their SIPs in the past year may be asking themselves: Why is the return on their systematic investment plan (SIP) so low in the last year? Is it a good idea at all to keep the SIP going in volatile markets? Let us remind ourselves that SIP is not an investing option: it is a tool to execute an investment strategy. When there is a concern on the quantum of returns after having done the ‘right’ thing of starting an SIP without any regard whatsoever on market timing, we naturally question the SIP.

The reason why the equity SIPs of the last year have not done well is simple: the equity indices are lower now than where they were last year. Investments made through the year at higher levels of the index, are now being valued at a lower level of the index. The result is a negative return. This however does not make the SIP a bad investment choice, it only points out its limitations to an investor who worries about market timing.

In an ideal world, if the investors could perfectly time the market, they would begin to buy only when the markets have bottomed out. Or they would sell off at the top. Most of us would accept that finding such a turning point in time, and investing a significant amount to benefit from such timing (excepting of course, by a stroke of sheer luck) is tough. To actually execute such timing, investors would have to start selling in a rising market, or keep buying in a falling market. An SIP enables such consistent participation in the market – that is its big merit as a fine execution strategy.

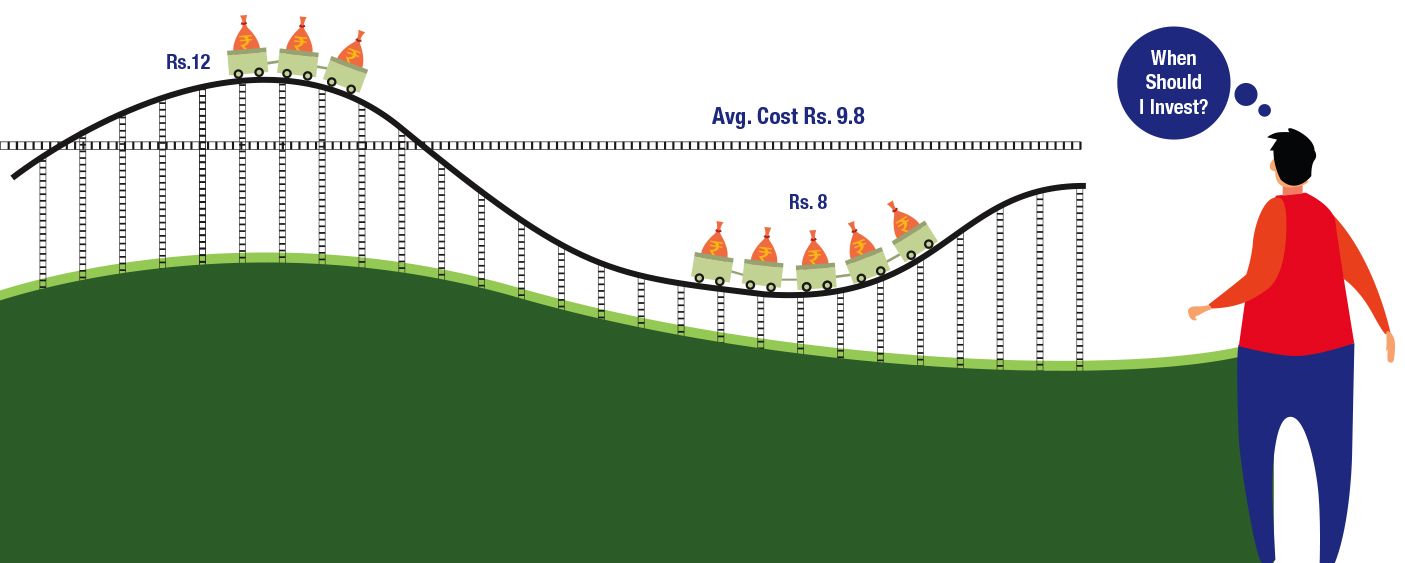

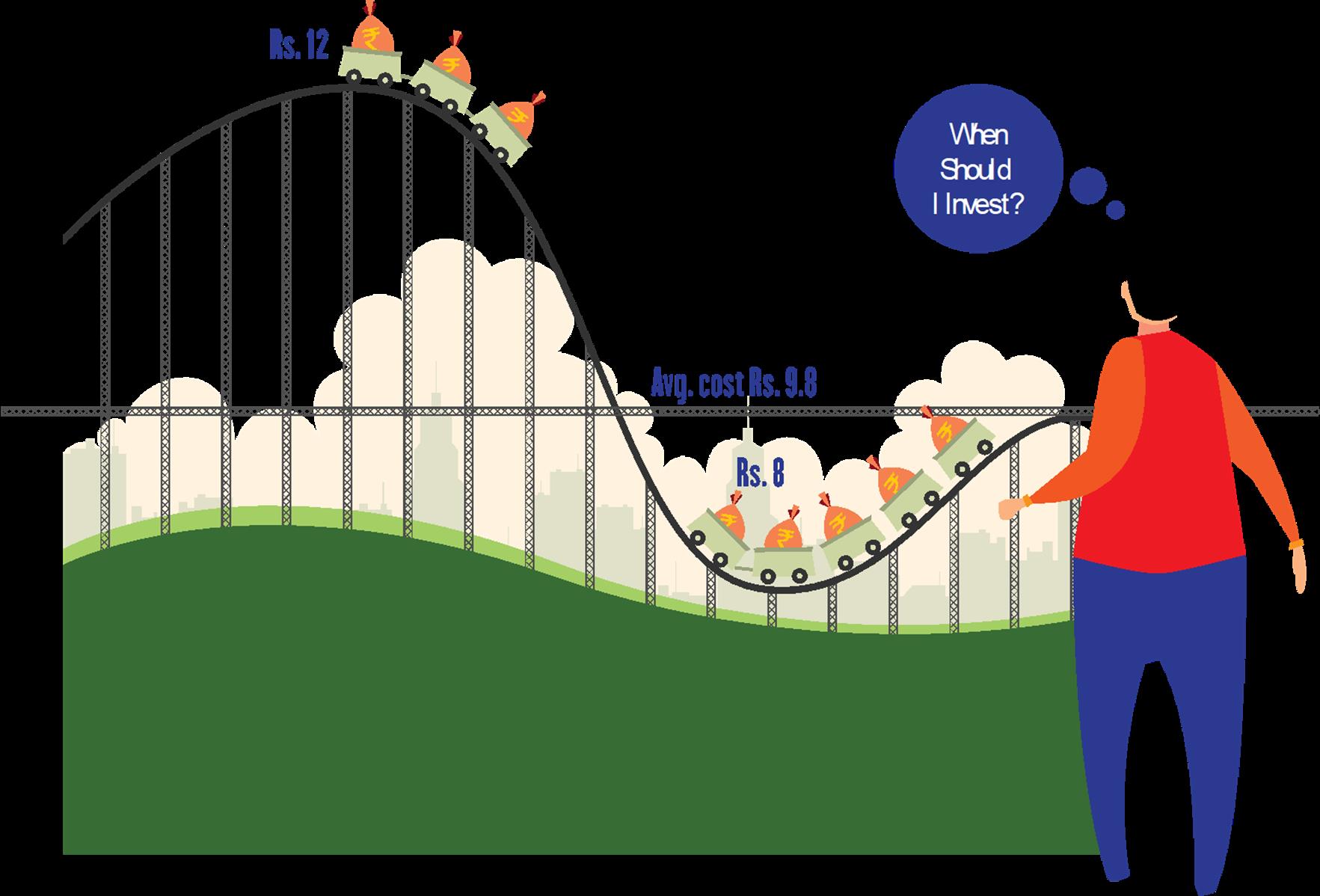

Now let us compare an SIP investment versus a lump sum investment. For a lump sum investment to do better, it would have to be timed to perfection and invested at the start of any market up cycle. An SIP by virtue of its continuity participates in the up cycle as the price moves up, and therefore acquires units consistently at various prices. If the investor fears a further fall in the markets, persisting with the SIP will do immensely better, participating in the fall and securing low average prices for the investment. A lump sum investment requires correct timing to succeed, SIP only requires persistence.

Should SIPs be discontinued when return is low and the markets are falling? No. That would be detrimental to long term return. In your investment journey, you may be prone to regret and fear due to market correction.But remember that market fall gives you the opportunity to accumulate more units, which will appreciate in value when the market cycle turns.

If you discontinue your SIPs, you might find it extremely difficult to enter back and you will miss the bus. A market correction would be an opportunity for you to buy low and sell high but you keep waiting on the sidelines. To fulfill this secret desire of yours, more units are purchased when a scheme’s NAV is low (during market low) and fewer units when the NAV is high (during market up). Over a market cycle, your average cost over a long time frame will be effectively lower. Those investors who stuck to their SIPs in 2008 and 2020, realised that given a choice they might not have continued to invest, but managed to participate amidst widespread pessimism, only because of the SIP. It is the falling market that makes it possible to buy low and accumulate more units, so that you get superior returns once the market turns and begins it up move again.

Expert tip: There is a persistent group of investors who like the SIP, but cannot help actively timing the market. They currently hold a large surplus which they have not invested due to the market uncertainties. They like the high return in the short-term debt market which they believe will do better than equity markets, in the intermediate term of 2-3 quarters. They also like the idea of participating in the equity market as it is falling, using an SIP. Such investors can use a systematic transfer plan (STP). They can deploy their surplus in a short term debt fund, and ask for a fixed amount to be switched to an equity fund, periodically, over the next 2-3 quarters. They earn interest as long as the boom in the short term markets last, and implement their equity participation through the downturn, in readiness for the next up cycle. SIPs have nothing to offer in terms of nuance, style, or strategy but they are excellent tools to disciplined participation in volatile markets.